Banks in the UK set mortgage rates based on a variety of factors, including the Banks Set Mortgage Rates UK, the lender’s own cost of funds, and competition in the mortgage market.

The base rate, also known as the “Bank Rate”, is the rate at which banks can borrow money from the Bank of England. This rate is set by the Monetary Policy Committee (MPC) of the Bank of England, which meets regularly to discuss economic conditions and make decisions about interest rates. The base rate is used as a benchmark for setting the rates on mortgages and other loans. When the base rate changes, it can have a direct impact on the rates offered by banks for mortgages.

Lenders will also consider their own cost of funds, which includes the cost of borrowing money from other sources, such as wholesale markets, and will factor in a profit margin. Banks Set Mortgage Rates UK may borrow funds from other sources such as bond markets, and then lend them to customers at a higher rate.

Competition in the mortgage market can also play a role in determining rates. In a competitive market, lenders may adjust their rates to be more competitive with other lenders in order to attract more customers. This can result in lenders offering lower rates to try to attract customers.

The lender also takes into account the creditworthiness of the Documents Required For Education Loan in Canara Bank, the deposit of the borrower and the loan to value ratio of the mortgage.

Overall, banks will use a combination of these factors to set mortgage rates. It is important to note that these factors can change over time, and as a result, mortgage rates can fluctuate. It is advisable to research the mortgage market and compare rates from different lenders before making a decision about a mortgage.

Mortgage rates guide

A mortgage rate – or mortgage financing cost – is how much premium you’ll pay on the cash you get to purchase a property. The rate on your mortgage is shown as a rate. For instance, you might have a financing cost of 4% each month.

Mortgage rates are frequently connected to the public financing cost, however they’re not exactly the same thing.

- Loan cost – The level of interest you pay for any sort of acquiring.

- Mortgage rates – The loan cost for a mortgage bargain.

- Base rate – The loan cost set by the Bank of Britain.

Our aide will make sense of what mortgage rates are, how they’re set and the various kinds of mortgage rate that may be accessible to you.

What influences the mortgage rates proposed to you

Each Banks Set Mortgage Rates UK will think about various standards, however these are a portion of the normal components they’ll see while concluding which loan fee to offer.

Financial record

Your financial assessment impacts the mortgage rate you’re offered, as it shows your history of taking care of advances and whether you’re probably going to stay aware of your mortgage reimbursements.

Store size

The cash you get when you take out a mortgage is worked out by removing your store from the price tag of your new home. A higher store gives a superior credit to esteem proportion. A superior credit to esteem proportion implies you’ll likely be offered lower financing cost bargains.

Length of the mortgage term

Assuming that you pick a mortgage that is reimbursed over a more limited period, you might have higher regularly scheduled installments, yet pay less interest.

In the event that your mortgage reimbursements are spread throughout a more extended time, you might pay less on your reimbursements, yet more interest. A mortgage counsel can assist with suggesting a term that works for your conditions.

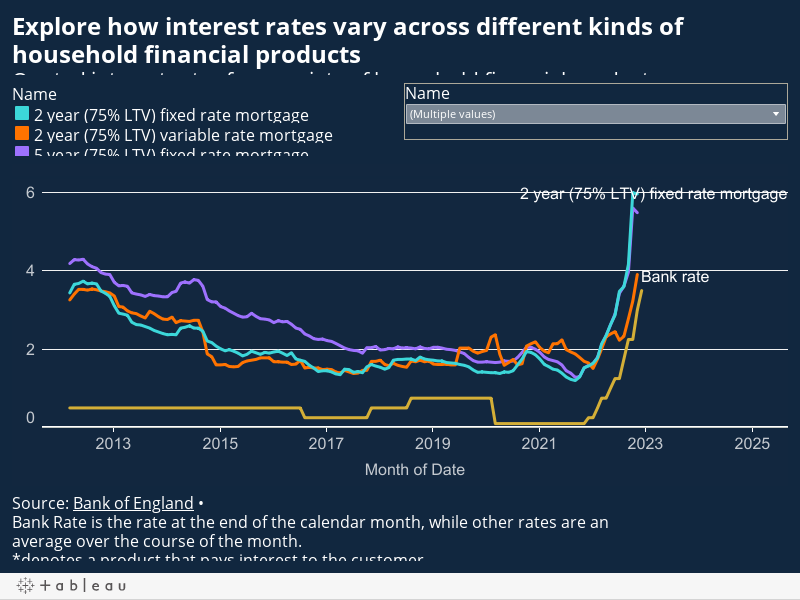

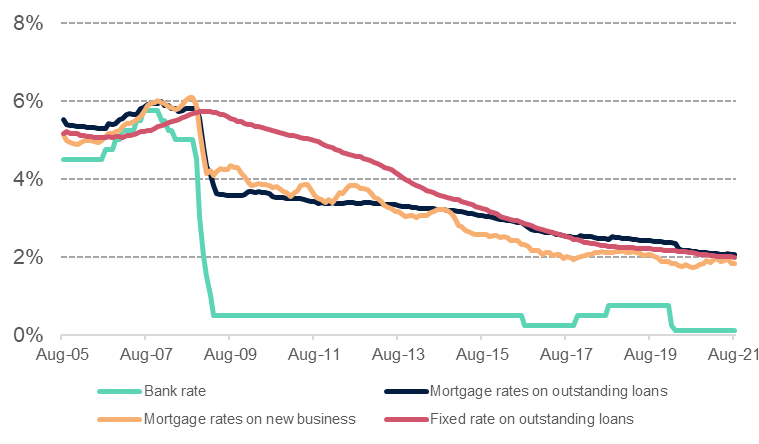

How the Bank Rate influences mortgage rates

As shown in Diagram 1 above, ongoing history lets us know mortgage rates have declined progressively to approach record lows while the Banks Set Mortgage Rates UK has remained to a great extent static. For the couple of humble expansions in Bank Rate north of 2017 and 2018, mortgage rates didn’t increase by a similar edge and got back to their continuous downward pattern soon after. Solid market contest and prepared supply of discount subsidizing have been significant drivers in keeping rates low.

This ascent in the Bank Rate is the littlest starting around 1989, so regardless of whether mortgage rates move more in accordance with Bank Rate than has been the situation lately, the impact on mortgage rates will be equivalently humble.

Who may be impacted by this change?

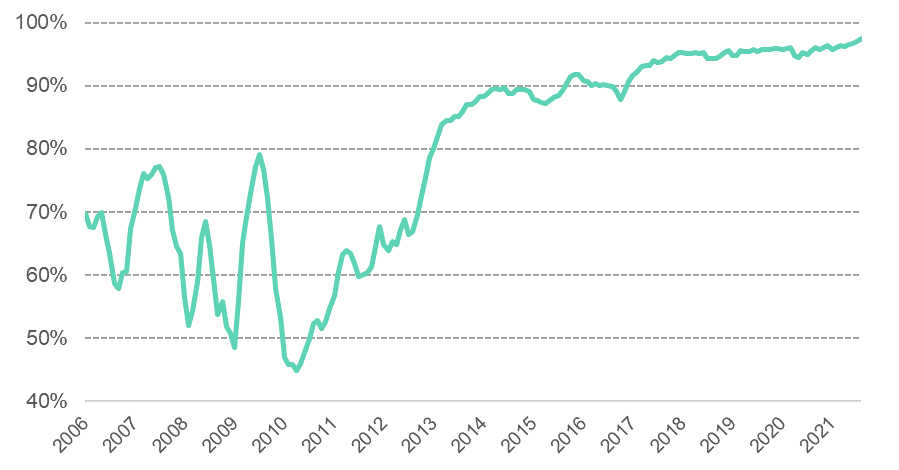

For most mortgage borrowers, the adjustment of the Bank Rate will meaningfully affect their mortgage rate for the time being. Presently, 74% of property holder mortgages are on a decent rate contract, with 96% of new borrowers picking this choice beginning around 2019 (as shown in Graph 2). Consequently, a sizeable greater part of borrowers will see no prompt expansion in their month to month reimbursements.

Moreover, the extent of fixed rate mortgage borrowers settling on five-year fixed rates has expanded fundamentally as of late, from less than three out of ten borrowers in 2017 to around 45% of borrowers in 2021. The extent of those on two-year fixed rates has seen a diminishing of a comparable greatness over a similar period, proposing a rising number of borrowers have been ?securing for longer? to exploit the close record low rates. Thus, a sizeable extent of borrowers are probably going to see no adjustment of rates and subsequently month to month reimbursements in the medium term.

The Banks Set Mortgage Rates UK declaration will in all probability influence mortgage borrowers who have variable rate mortgages. Roughly 850,000 mortgage borrowers have a tracker rate mortgage at present: UK Money gauges that an ascent in the Bank Pace of 0.15 rate focuses will prompt a normal expansion in reimbursements by £15.45 each month. For the individuals who are on a standard variable rate (SVR) ? around 1.1 million mortgage borrowers – this ascent means an expected increment of £9.58 each month by and large.

Conclusion

Mortgage rates have kept on declining lately notwithstanding little development in the Bank Rate, to a great extent because of kept flourishing rivalry in the mortgage market.

The ascent in the Banks Set Mortgage Rates UK to 0.25 percent won’t influence anywhere close to 3/4 of all mortgage borrowers temporarily, and this will reach out into the medium term for the huge volume of borrowers got into longer term fixed rate items. While around 2,000,000 borrowers on factor rates will see their month to month mortgage installments expansion temporarily, these increments are probably going to be exceptionally humble with rates expected to remain historically low in general.