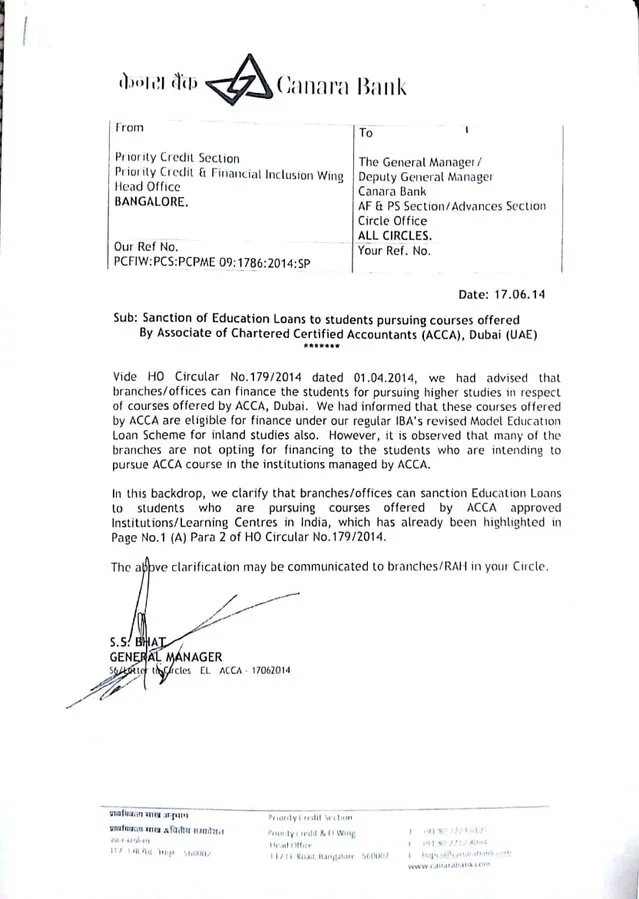

Education Loan gives financial guide to deserving and worthy understudies to seek after higher examinations in India and abroad. It assists understudies with paying their educational expenses, examination, library, books, research facility and inn while studying. It likewise covers travel costs for studying abroad, concentrate on visits, project work, refundable store, and so on. Banks will gives you an Education Loan in Canara Bank on the off chance that you are qualified for education loan. Banks required beneath recorded documents when you apply for education loan.

An education loan is the most effective way to support your advanced education abroad. The essential explanation is that a constant flow of income is ensured. This certainty in finances is a tremendous in addition to point during your visa interview. Obtaining a Personal Loan is one among the numerous Administration Bank Education Loan Plans to consider. While education loans from SBI and Bank of Baroda are the most famous, an Education Loan in Canara Bank from Canara Bank is a decent substitute choice for understudies planning to concentrate abroad.

Education Loan Record Required

For Salaried Individuals

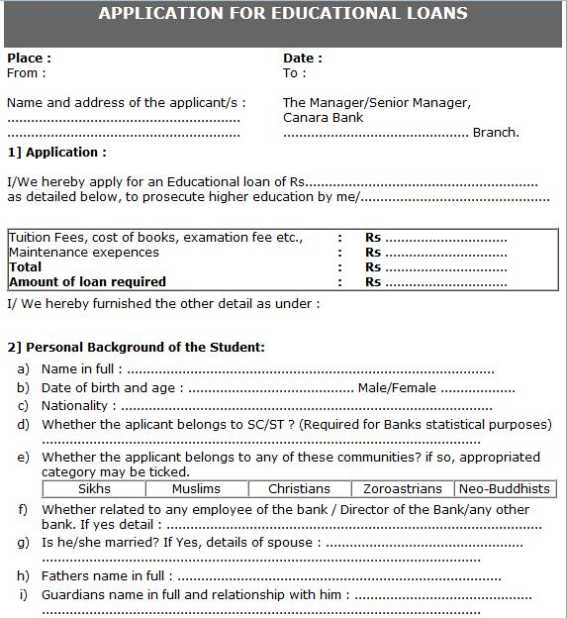

- Properly topped off and marked Education Loan in Canara Bank application form alongside photos

- KYC (Know Your Customer)documents

- Verification of character Visa, Elector ID card, Driving permit, Container card, Aadhar Card, Government division ID card

- Most recent compensation slip showing all derivations or Form 16 alongside late compensation endorsement

- Evidence of home – Bank account explanation, Most recent power bill, Most recent versatile/phone bill, Most recent financial record, Existing house rent understanding

- Bank Explanation or Bank Pass Book of having sections of most recent a half year

- Underwriter Form, Duplicate of affirmation letter or the Institute alongside Charges plan (Discretionary)

- Mark sheets/pass testaments of S.S.C., H.S.C, Degree courses (Discretionary)

- Definite separation of the expenses of the course (Discretionary)

For all Individuals Except Salaried

- Properly topped off and marked Education Loan in Canara Bank application form alongside photos

- KYC (Know Your Customer)documents

- IT returns of the most recent 2 years and calculation of income of most recent 2 years guaranteed by a Contracted Bookkeeper

- Verification of character Visa, Citizen ID card, Driving permit, Dish card, Aadhar Card, Government division ID card

- Verification of home – Bank account explanation, Most recent power bill, Most recent versatile/phone bill, Most recent financial record, Existing house rent understanding

- Bank Explanation or Bank Pass Book of having sections of most recent a half year

- Underwriter Form, Duplicate of affirmation letter or the Institute alongside Expenses plan (Discretionary)

- Mark sheets/pass authentications of S.S.C., H.S.C, Degree courses (Discretionary)

- Nitty gritty separation of the expenses of the course (Discretionary)

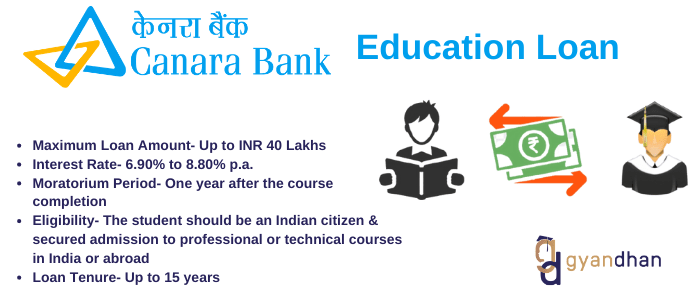

The MCLR is as of now 9.65%. What’s more, the Pace of Interest for Canara Bank Education Loan is MCLR (Marginal Expense of Assets Based Lending Rate)+ 1.5%. There is a 0.5% decrease in the Education Loan in Canara Bank return on initial capital investment for female understudies, as in each administration bank.

Benefits Of A Canara Bank Education Loan

- Low-interest rate

- No security required

- Adaptable reimbursement choices

- Speedy endorsement process

Canara Bank offers an exceptionally serious interest rate ranging from 8.25% to 9.25%. This is lower than the rates presented by different banks, making it an appealing choice for borrowers.

Eligibility Criteria

The qualification rules for the Canara Bank Education Loan Without Guarantee are as per the following:

- For all Individuals Except Salaried

- Education Status: The up-and-comer ought to be a register or undergrad to apply for this loan.

- Citizenship: An up-and-comer should be an Indian resident to apply for this loan.

- Income: Your all out income ought to be between Rs 50,000 and Rs 1 lakh each month or a yearly compensation of Rs 2 lakhs with a minimum of two years of involvement with a similar assignment.

Documents Required For Canara Bank Education Loan

- Identification size photo

- Age verification Birth testament or school leaving declaration or Rank/Clan Authentication

- Address verification Elector ID card, Driving permit or some other service bill like bank articulation.

- Rank/Clan Authentication if pertinent

- Income declaration (for salaried up-and-comers) with ongoing compensation slips.

The documents referenced above are required to be submitted at the hour of loan application while submitting movement documents will be obligatory at the hour of dispensing.

Conclusion

In this way, in the event that you are an understudy and looking to reimburse the Education Loan in Canara Bank without security then, at that point, we propose you feel free to apply for the Canara Bank Education Loan without guarantee. We trust that this guide has assisted you with every one of your inquiries regarding Canara bank’s education loan. You may likewise peruse a portion of our different websites of interest .