In this article we will talk about enrollment of Health insurance in California. You might have known about the expression “open enrollment.” This alludes to the period of time every year — as a rule from November through January — when you can purchase health insurance or change your health plan.

In many circumstances, you need to wait until open enrollment to purchase another health plan or change an existing one — and with justifiable cause. Restrictive timing monitors the expense of health insurance for everybody by preventing individuals from enrolling just when they are sick or injured. You can’t wait and get property holders insurance after your cellar floods; similar standards apply for health insurance.

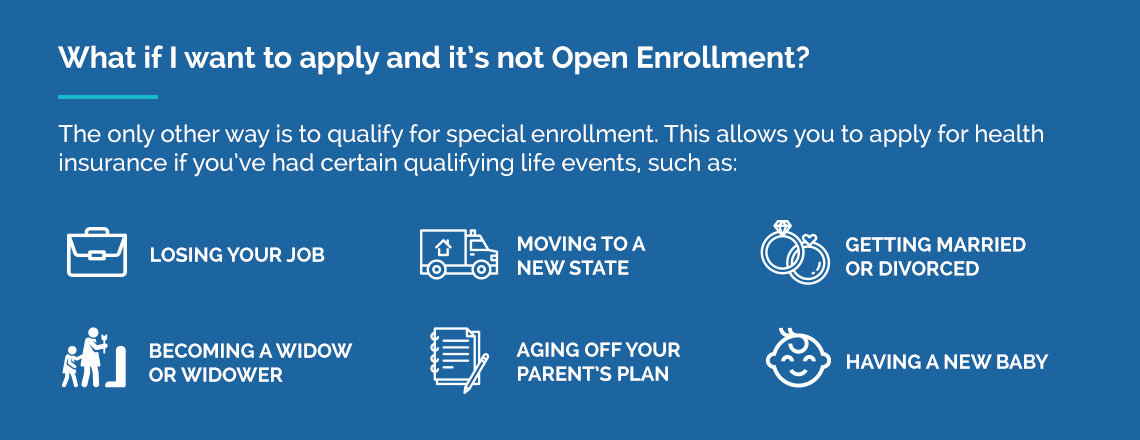

If you miss the enroll-by date, you might need to wait until the following open enrollment period — however there are a few exceptions. If you carry on with a significant life change, you might still have the option to apply for health insurance with Covered California under special enrollment. A special enrollment window is triggered when you experience a qualifying life occasion — like losing your ongoing health insurance, getting married, or having a child — and for most qualifying life occasions, you have 60 days from the date of that occasion to enroll.

Simple steps to get you through open enrollment in health insurance in California

Start open enrollment early

Familiarize yourself with what options Blue Shield is offering. Review your restoration booklet that was mailed to you. You can likewise review some plan comparison graphs.

Schedule time to assess

This is a basic step, however it can have a significant effect. Open enrollment is November 1 through December 31, 2023, and it can go by before you know it. During that first seven day stretch of open enrollment, book some time (an hour or thereabouts, to add some cushion) to review your ongoing plan. Try not to cancel on yourself. Be ready with whatever items you’ll require. In your Blue Shield Reestablishment Booklet that was mailed to you is an Open Enrollment Checklist that you might find helpful.

Take this quick health plan assessment

Start with your health plan assessment. It will take only 10 to 15 minutes and it poses 5 key inquiries that will help you select the plan that fits you and your family best – whether that is a similar plan you have now or another one. As you review plans, this assessment will help you eliminate the ones that don’t work for you. Restricted them down to a couple of options until one stands apart the most.

See if you qualify to receive financial help

You might be eligible for financial help in the form of a subsidy. Utilize our calculator to estimate how much premium help you could receive.* To utilize a subsidy, you will have to enroll in a medical plan sold through Covered California. Yet, not to stress – if you need to keep your equivalent Blue Shield plan, you might have the option to. Large numbers of a similar Blue Shield plans are likewise sold on Covered California. Or on the other hand we might include a similar plan inside a similar organization. We have a plan outline and a checklist than can help.

Reach out with questions

Scheduling time to investigate your options and taking notes gives you time to sit with your decisions to encourage sure they. Sometimes, last-minute questions bubble up, and this way, you’ll have a built-in cradle for that. If you truly do have questions, reach out to your merchant or get in touch with us. You can likewise utilize the Restoration Community website for replies.

When can you apply for health insurance California?

Covered California 2021-2022 Open Enrollment Period: Nov. 1 – Jan. 31. Open enrollment is the period during which individuals can buy health insurance for the upcoming year.

Under California Regulation Waiting Periods Are Limited to 60 Days or Less – California statutory regulation likewise requires that completely insured health plans may not apply a waiting period longer than 60 days.

The initial waiting period in health insurance might be different for different insurers. Additionally, there can be a few exceptions connected with this waiting period in health insurance, like accidental claims for immediate hospitalization. As a rule, the minimum initial waiting period[1] is no less than thirty days.

Californians can now sign up for affordable health insurance through Covered California. The state’s Affordable Consideration Act commercial center, as open enrollment begins for 2023.

What is penalty for not having health insurance in California for 2 months?

By and large, the penalty for not having health insurance in California is either 2.5 percent of the family’s yearly income or $800 per grown-up and $400 per child, whichever of these two numbers is more prominent.

When you take out health insurance for the first time. You might need to serve waiting periods before you are completely covered. Yet accident and injury will be covered immediately. If you are changing to a health insurance plan with improved benefits there might be a waiting period before the higher benefits apply.

One can select instant health insurance policies now. These plans offer multiple benefits including lower premiums, immediate policy issuance. Elimination of complicated administrative work, simplicity in comparing premium statements, and so on.