The average interest rate for a 5-year Interest Rate on a Mortgage in Canada is currently around 2.5% to 3.0%. However, rates can vary widely based on the lender and the specific terms of the mortgage. For example, interest rates may be higher for borrowers with lower credit scores, or for those with smaller down payments. Additionally, interest rates can also vary by region, with rates generally being higher in larger cities like Toronto and Vancouver, where housing prices are higher.

It’s also worth noting that the interest rate is not the only factor to consider when shopping for a mortgage. Homeowners Insurance Cover Landslides considerations include the length of the mortgage term, the type of mortgage (fixed vs. variable), and any associated fees or penalties. It’s always best to consult with a financial advisor or a mortgage broker to help you understand the best options available to you and make an informed decision.

We compare the most competitive brokers, lenders and banks in Canada to bring you today’s lowest interest rates, free of charge. Interest Rate on a Mortgage in Canada at the top of this page are updated every few minutes, so they are the best rates currently on offer. To better understand what rate you could be eligible for in a few simple steps, get a mortgage quote – again, it’s completely free to use and you’re under no obligation whatsoever.

What Affects Your Mortgage Rate in Canada?

There are many various kinds of mortgages in Canada. Each mortgage typically has the selection of two unique rates:

- Fixed Rate

- Variable Rate

These mortgage rate options will affect how your interest rate changes over the long run. Fixed rates are historically the most common, trailed by variable rates. This changed in late 2021, when variable rate mortgages became more normal because of low variable rates and high fixed rates. By the start of 2022, 56.9% of all new mortgages had a variable interest rate, a stark contrast to 24.7% of new mortgages having a variable rate in early 2021.

While more uncommon, there are also cross breed/combination Interest Rate on a Mortgage in Canada. With a cross breed/combination rate, you’ll have a proper rate for a certain portion of your mortgage balance, and a variable rate for the remaining portion. This allows you to be partially shielded from rate climbs, while partially benefiting should rates decrease.

Choosing the mortgage with the best rate that’s ideal for you

Variable versus fixed mortgage rates

The distinction among fixed and variable Interest Rate on a Mortgage in Canada is whether or not they will change over the term of your mortgage. Fixed rates will stay the same throughout your mortgage term (usually 5 years), while variable rates will change alongside changes in your moneylender’s great rate.

Fixed mortgage rates:

Fixed mortgage rates are a historically popular option, with 5-year fixed mortgage rates accounting for nearly 66% of all mortgage demands made on Ratehub.ca in 2022. The advantage of a decent mortgage is that you are safeguarded against interest rate fluctuations, so your regular payments stay constant over the duration of your term, regardless of what happens in the market. A decent rate mortgage is ideal for you on the off chance that you have a low appetite for risk. You’ll realize the amount you’ll be paying monthly right all along and not have to monitor interest rates.

Variable mortgage rates:

Variable mortgage rates are typically lower than fixed rates however can vary over the duration of your term. Variable mortgages are prone to market behavior (via the superb rate) which affects your payments. That means your payment amounts can change over the long run.

While variable rates are generally lower, they in all actuality do fluctuate and can be seen as more risky when compared to fixed rates. That said, variable mortgage rates have a few key advantages you ought to be aware of:

- You can convert a variable rate to a decent rate at any time without a penalty as long as you stay with your original mortgage moneylender.

- Breaking a variable rate mortgage is substantially more affordable than breaking a decent rate mortgage. To estimate the expense of breaking your mortgage, our mortgage penalty calculator is a helpful instrument.

According to York College Teacher Moshe Milevsky’s landmark 2001 review, historically, more than 90% of Canadians who have maintained a Interest Rate on a Mortgage in Canada all through their whole mortgage term have paid less in interest than the people who have adhered to a proper rate.

Selecting a mortgage term

Choosing between a momentary mortgage or a long-term mortgage can also affect your interest rate. A transient mortgage generally offers a lower rate, and, as it requires more successive renewal, you can profit from lower interest rates when you recharge, in the event that rates stay low at your renewal. Long-term mortgages, on the other hand, offer stability, as you won’t have to recharge it frequently. Be that as it may, long-term mortgage holders may not have the option to take advantage of lower interest rates assuming the market fluctuates.

Open versus shut mortgages

On the off chance that you’re wondering whether to get an open or shut mortgage, the answer is, while an open mortgage may make sense in certain circumstances, the overwhelming majority of Canadians settle on a shut mortgage. While open mortgages have extra adaptability that you could require, shut mortgages are by a wide margin the more popular decision because of their lower rates, yet in addition because most home purchasers don’t intend to pay off their mortgages temporarily.

Shut mortgages:

Shut mortgages have lower rates compared to open Interest Rate on a Mortgage in Canada. Shut mortgages can come in fixed and variable structure, however place restrictions on the amount of principal you can pay as the year progressed. In the event that you pay off the whole principal in a shut mortgage before the set term, you will face a prepayment penalty, which is normally a 3-month interest charge.

Open mortgages:

Open mortgages allow you to pay off your whole mortgage balance at any time all through the term. The drawback is that you pay a premium for that option in the type of higher rates. You could pick an open mortgage assuming you are planning to move in the near future, or on the other hand assuming that you’re expecting a singular amount of money through an inheritance or bonus that would allow you to pay a greater amount of your mortgage off.

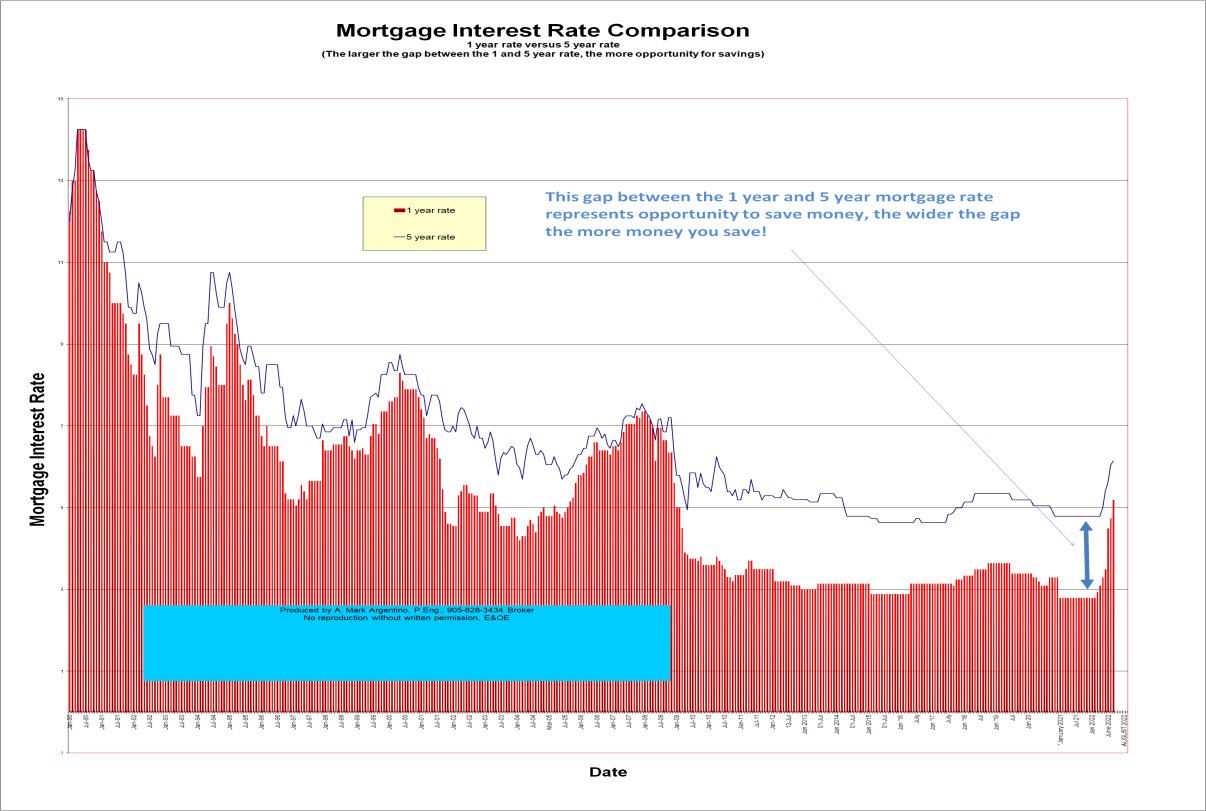

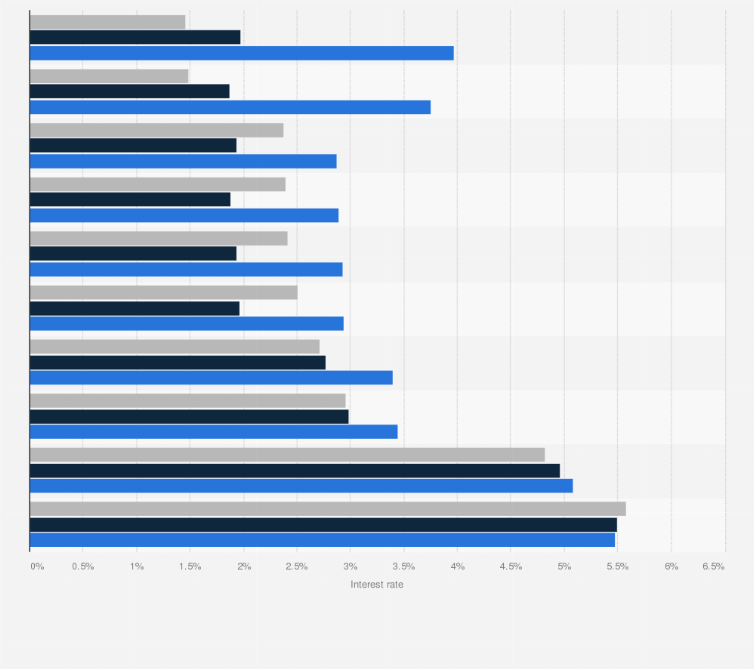

Historical Canada mortgage rates

Looking at historical mortgage rates is an effective method for understanding which sorts of mortgage attract higher rates. They also make it easier to understand whether we’re as of now in a low or higher rate environment, relatively speaking.

Here are a portion of Interest Rate on a Mortgage in Canada of the year for various kinds of mortgages throughout the course of recent years. A few moneylenders also extend to mortgage employment opportunity misfortune insurance. This can be packaged with mortgage disability insurance, for example, with CIBC’s Mortgage Disability Insurance In addition to.

For example, in the event that your top notch rate is $2.84 per $100 of mortgage payment, and your monthly mortgage payment is $2,000, then your expense of disability insurance will be $56.80 each month.