There are various mortgage repayment calculators available online for calculating how long it will take to Pay Off Mortgage Repayment Calculator in the UK. These calculators typically require you to input information such as the loan amount, interest rate, and loan term, and they will then calculate the estimated length of time it will take to pay off the mortgage, as well as the total amount of interest that will be paid over the life of the loan. Some examples of mortgage repayment calculators in the UK include those offered by the Money Advice Service, the government-funded financial advice website, and major UK banks such as Lloyds and Santander.

Ascertain how much you can acquire in the Frame Rate of Your Gaming PC with our basic mortgage calculator. Compute your month to month mortgage repayments to resolve how much you could stand to get while moving house, remortgaging, or buying your most memorable home.

With regards to mortgages, the issue of how much you can bear the cost of as far as the repayments is similarly basically as significant as how much the mortgage supplier will loan you. Our speedy Pay Off Mortgage Repayment Calculator will give you a smart thought with regards to how much you will be supposed to repay each month. If it’s not too much trouble, note, the calculator is intended to give an indication as it were. You may likewise be interested in calculating how much you could get for a mortgage.

How to work out your mortgage repayments

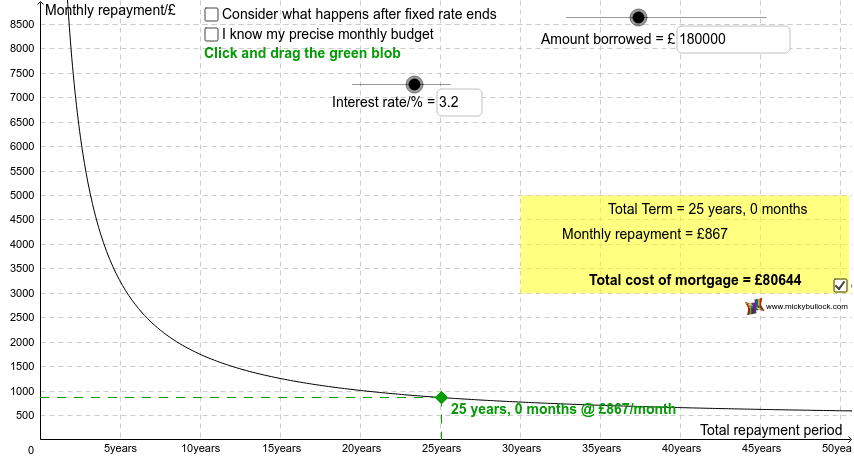

Gauging the rough expense of your month to month repayments using our mortgage calculator is simple. In the first place, basically input in the total sum that you think you’ll have to get and detail what number years you would like the credit over – typically for new mortgages for first-time purchasers this will associate with 25 years, however more banks are currently glad to offer mortgages over times of as long as 40 years.

Then, you really want to determine the interest rate in request to work out your month to month mortgage repayments. In the event that you have no clue about the mortgage interest rate, you can continuously investigate our mortgage correlation outlines to find out about the arrangements at present accessible for your requirements and conditions.

Finally, our Pay Off Mortgage Repayment Calculator should understand what sort of credit repayment you want: capital and interest or interest as it were. Try not to overreact on the off chance that you don’t know. Basically, capital and interest repayments imply that every month you pay off an extent of the total acquired in addition to interest, while interest just implies that you are simply paying off the month to month interest on your credit while never repaying the aggregate you’ve acquired. To find out additional about the various sorts of mortgage repayment choices – and those that might be appropriate for you – look at our helpful aide: Repayment and interest-just mortgages explained.

What does the month to month mortgage repayment calculator not cover?

If it’s not too much trouble, note that our month to month mortgage repayments calculator will just provide you with a thought of how much you’ll be paying each month for your mortgage. This includes no extra expenses ordinarily connected with buying a home, for example, stamp obligation, lawful charges, valuation and assessors expenses and item expenses to give some examples. For more information on this, investigate our manual for What expenses do I have to pay while getting a mortgage?

Also, the mortgage credit calculator works by taking one interest rate over the entire term you have determined. In the event that you might want to see the outcomes for a particular kind of item Pay Off Mortgage Repayment Calculator then you ought to allude to the delegate models for every item on our mortgage correlation outlines. This calculator is intended for private mortgage repayments and doesn’t have any significant bearing to purchase to-let mortgages. This office is additionally not intended to be an overpayment calculator.

Tracker Mortgage

A tracker mortgage is a sort of mortgage that follows the developments of different rates, the most widely recognized of which is the Bank of Britain base rate. Most banks in the UK favor variable-rate mortgages in some structure. Subsequently, there are a more extensive assortment of mortgages of this sort in the UK. A few mortgages begin as trackers and, following a couple of years, become standard variable-rate mortgages.

Introductory tracker rates can be among the most reduced mortgage interest rates accessible. However, similar to every variable rate, they can go up as well as down. Additionally, most introductory tracker rates will probably have an early repayment charge when remortgaged or reimbursed during the introductory period. Borrowers with a lifetime tracker mortgage can hope to see early repayment charges for a period subsequent to being taken out.

Adaptable Mortgage

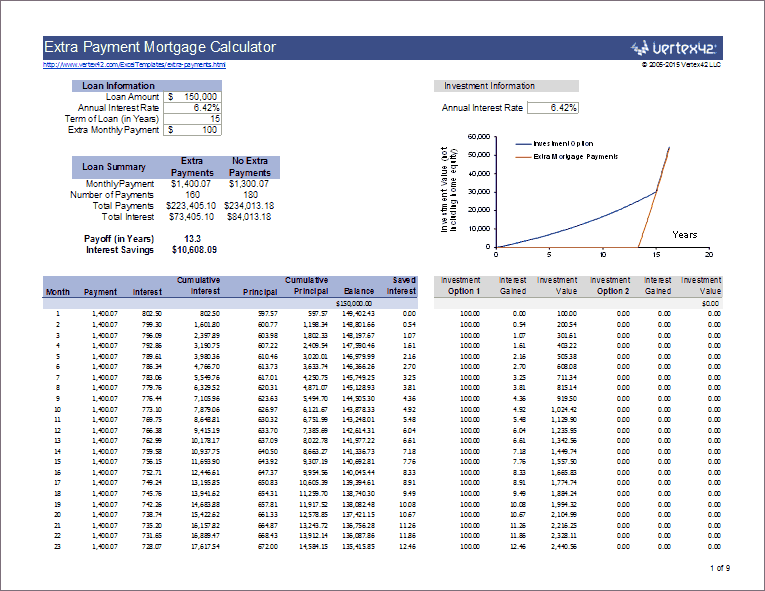

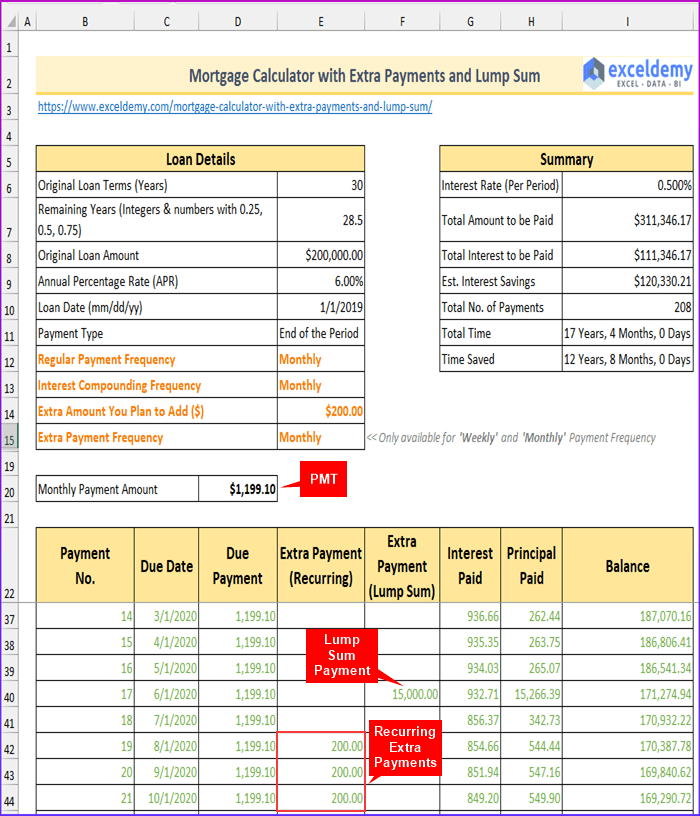

An Pay Off Mortgage Repayment Calculator type that permits the borrower to overpay, underpay, or take a payment occasion from a mortgage every once in a while. The overpayment element can be utilized to pay the advance down quicker, either in single amounts or as a component of the standard payment process.

The underpayment highlight is utilized to make lower regularly scheduled payments occasionally, and payment occasions can be utilized to stay away from payment for brief stints, at times as long as a half year. However, these highlights as a rule accompany extraordinary charges and conditions, so look around cautiously and analyze the expenses of adaptable mortgages.

Stamp Obligation

A special part of Pay Off Mortgage Repayment Calculator in the UK is stamp obligation, which is an expense that is charged as a level of the price tag when a property is purchased. Depending on the cost section that the property falls in, the rate can differ:

- Up to £250,000 – 0%

- From £250,001 to £925,000 – 5%

- From £925,001 to £1,500,000 – 10%

- More than £1,500,001 -12%

There is an extraordinary rebate (help) for first-time purchasers on the off chance that the price tag is £625,000 or less. Stamp charge isn’t appropriate for first-time purchasers of properties worth £425,000 or less and the existing pace of 5% will apply somewhere in the range of £425,000 and £625,000. Properties over £625,000 adhere to similar guidelines as purchasers not buying interestingly.