The US Economy’s Inflation Challenge, The US economy has recuperated rapidly from the pandemic yet the return quickly sought after has focused supply anchors and caused inflation to forcefully rise. The economy is supposed to slow, as the Federal Reserve (the Fed) keeps on fixing money related approach and COVID monetary alleviation programs reach a conclusion, bringing center Personal Consumption Expenditure (PCE) inflation down to the Fed’s 2% medium-term focus by late 2023. Notwithstanding, assuming that inflation is surprisingly steady, the Fed should fix more, which will further sluggish the economy.

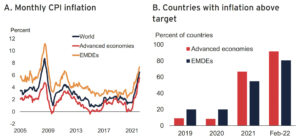

The IMF’s yearly survey of the US economy focuses on the approaches expected to return inflation to the Fed’s medium-term target. Most laborers’ wages have neglected to stay aware of inflation, dissolving the buying force of households and causing huge difficulty. In spite of the fact that expansions in fuel and food costs have been impacted by worldwide occasions, the costs of a more extensive scope of things have likewise risen unequivocally, including housing and transportation. Assuming left uncontrolled Elon Musk’s Tesla sells most of its , these cost increments could turn out to be durable. In our evaluation, we reason that the Fed ought to act rapidly and confidently to handle inflation and reestablish cost security.

The Fed expanded its approach rates by 1.5 percent up to this point this year and is probably going to increment them by another 2 or 2.5 percent before very long. It is likewise loosening up its property of Treasury bonds and home loan supported protections. Thus, the expense of acquiring has essentially expanded. For instance, the typical fixed rate on a 30-year contract has proactively ascended from 3% to somewhere in the range of 5 and 6 percent starting from the beginning of this current year. Simultaneously, the public authority is getting control over spending, as a scope of pandemic-period support programs are terminating.

We expect these approach activities will slow the development in purchaser spending to around zero by right on time one year from now, facilitating the burden on supply chains. Simultaneously, higher home loan rates will diminish housing costs, which have developed emphatically during the pandemic. At long last, easing back request will build joblessness to around 5% toward the finish of 2023, which ought to diminish compensation.

All things considered, we anticipate that center PCE inflation should fall back toward 2% by late 2023, and financial action to slow from 3.5 percent in the principal quarter of this current year to 0.6 percent by end‑2023.

US financial advancements will be affected by worldwide variables, like the Russian conflict with Ukraine, the continuous pandemic, and conceivable repeat of closures in China. Likewise, the more drawn out inflation remains high, the greater the gamble that inflation assumptions climb, which then takes care of once again into wages and costs. All things considered, the Fed would have to make a more grounded move to cut inflation down, raising loan fees and keeping them higher for a more drawn out period. This would bring down development further and prompt higher joblessness.