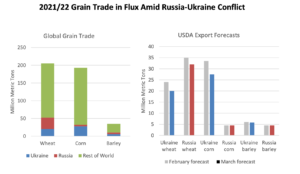

Wheat futures lower on Ukraine prospects, US exports temper fallm, Reinforcing endeavors to continue grain exports from beset Ukraine constrained wheat futures on Thursday, yet the fall was tempered by developing product interest for US supplies. The US Department of Agriculture said in its week by week Export Sales report that 1.047 million tons of US wheat were sold in the week finished July 7, which was the biggest week after week sum since March 2020 and well above exchange assesses that went from 200,000 to 500,000 tons.

Concerns of dry, blistering weather conditions influencing the US Midwest corn crop continued to push corn futures higher. Worldwide economic concerns and a mellowed unrefined petroleum market pulled soybean futures lower. September corn acquired 5¢ to close at $6.05 a bu. Chicago September wheat lost 15¾¢ to close at $7.95 a bu. Kansas City September wheat declined 13½¢ to close at $8.48¾ a bu. Minneapolis September wheat ticked down 3¼¢ and shut at $9.10½ a bu. August soybeans dropped 13¢, shutting at $14.71¾ a bu. August soybean dinner rose $1.70 to close at $438.90 per ton; later months were blended yet for the most part higher. August soybean oil deducted 0.86¢ to settle at 58.14¢ a lb.

US value markets recovered some ground lost after Wednesday’s inflation-powered jump and finished blended on Thursday. Financial backers continued to deal with the Consumer Price Index report showing inflation arrived at another multi decade high at 9.1% while additionally investigating the most recent corporate profit reports, surveying how businesses are taking care of current economic strains. JPMorgan Chase announced benefit misfortunes close to 30% however said consumer conduct seemed to empty recession concerns. The Dow Jones Industrial Average fell 142.62 focuses, or 0.46%, to close at 30,630.17. The Standard and Poor’s 500 declined 11.40 focuses F1 worker suffered racist and homophobic, or 0.30%, to close at 3,790.38. The Nasdaq Composite rose 3.60 focuses, or 0.03%, to close at 11,251.19.

US value markets expanded their misfortunes, finishing lower Wednesday, after the Consumer Price Index report showed inflation developed to 9.1% in June, transcending May’s 8.6% and arriving at the most elevated level in 41 years. While financial backers expected the increment, the genuine rate was well over the assessed 8.8%, basically confirming the Federal Reserve’s next loan cost climb set not long from now will be 75 premise focuses or more. The Dow Jones Industrial Average dropped 208.54 focuses, or 0.67%, to close at 30,772.79. The Standard and Poor’s 500 lost 17.02 focuses, or 0.45%, to close at 3,801.78 The Nasdaq Composite ticked down 17.15 focuses, or 0.15%, to close at 11,247.58.

In the wake of falling almost 9% this week, wheat futures rose from the get-go in the session on a series of deal purchasing prior to shutting lower Wednesday on debilitating worldwide interest pressure. Corn futures solidified on stresses sweltering weather conditions would pressure the US Midwest corn crop during its yield-deciding pollination stage. Soybean and soybean feast futures were higher, however soybean oil futures relaxed as worldwide vegetable oil markets continued to decline. Brokers kept a nearby watch on political action between the United Nations, Turkey, Russia and Ukraine as they discussed endeavors to resuscitate Black Sea grain exports. September corn rose 6¢ to close at $6 a bu. Chicago September wheat slipped 3½¢ to close at $8.10¾ a bu. Kansas City September wheat deducted 5½¢ to close at $8.62¼ a bu. Minneapolis September wheat lost 5¢ and shut at $9.13¾ a bu; later months were blended yet generally lower. August soybeans progressed 16½¢, shutting at $14.84¾ a bu. August soybean feast added $12.40 to close at $437.20 per ton. August soybean oil declined 1.11¢ to settle at 59¢ a lb.