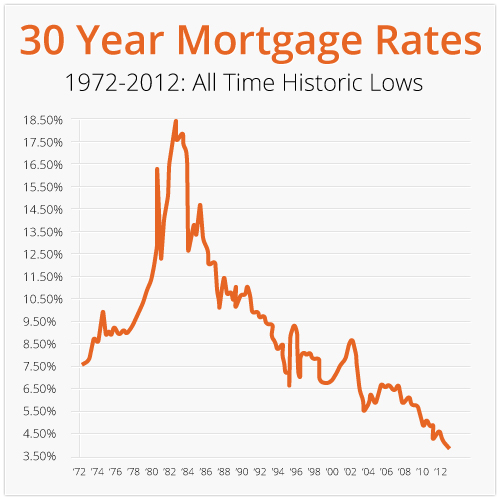

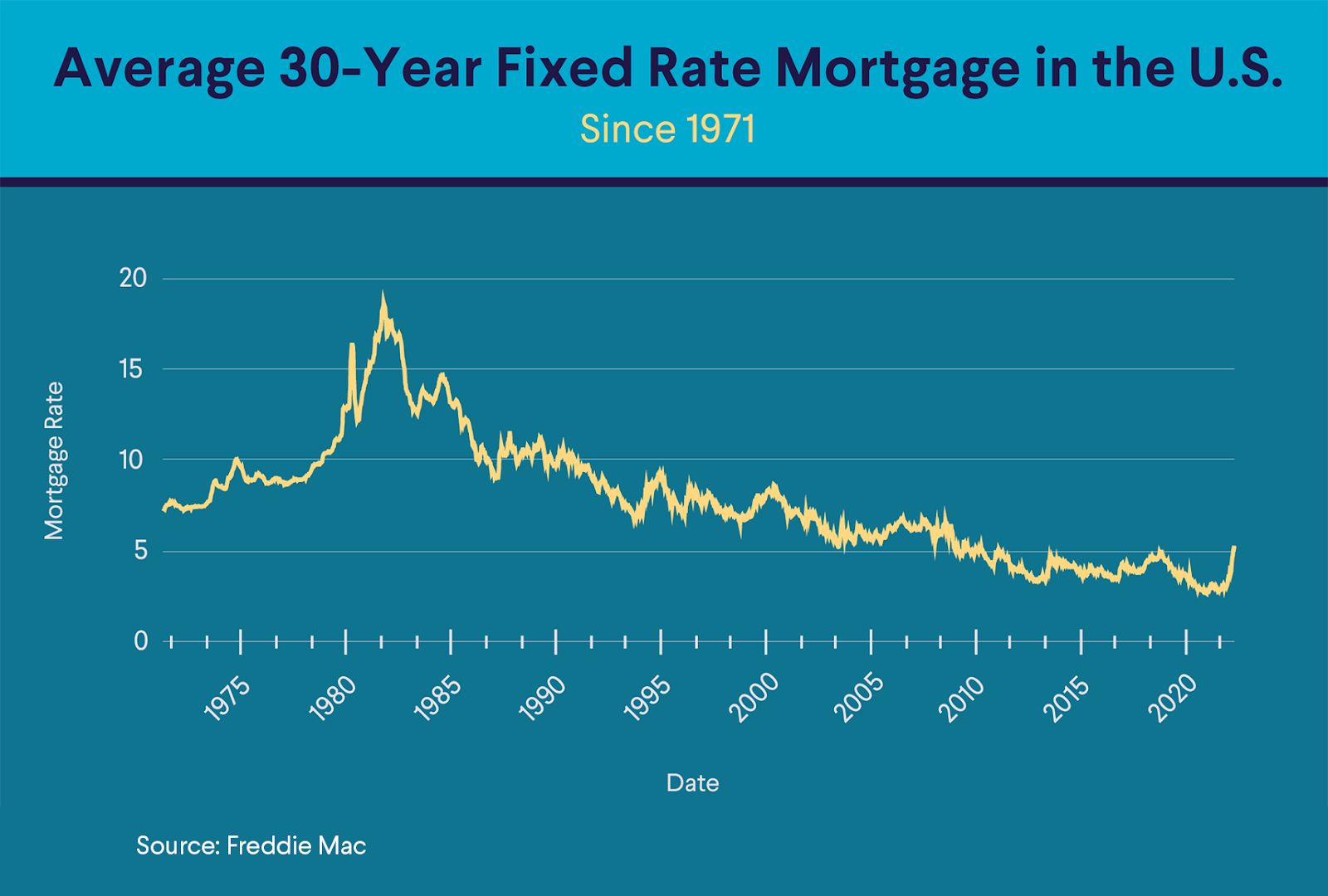

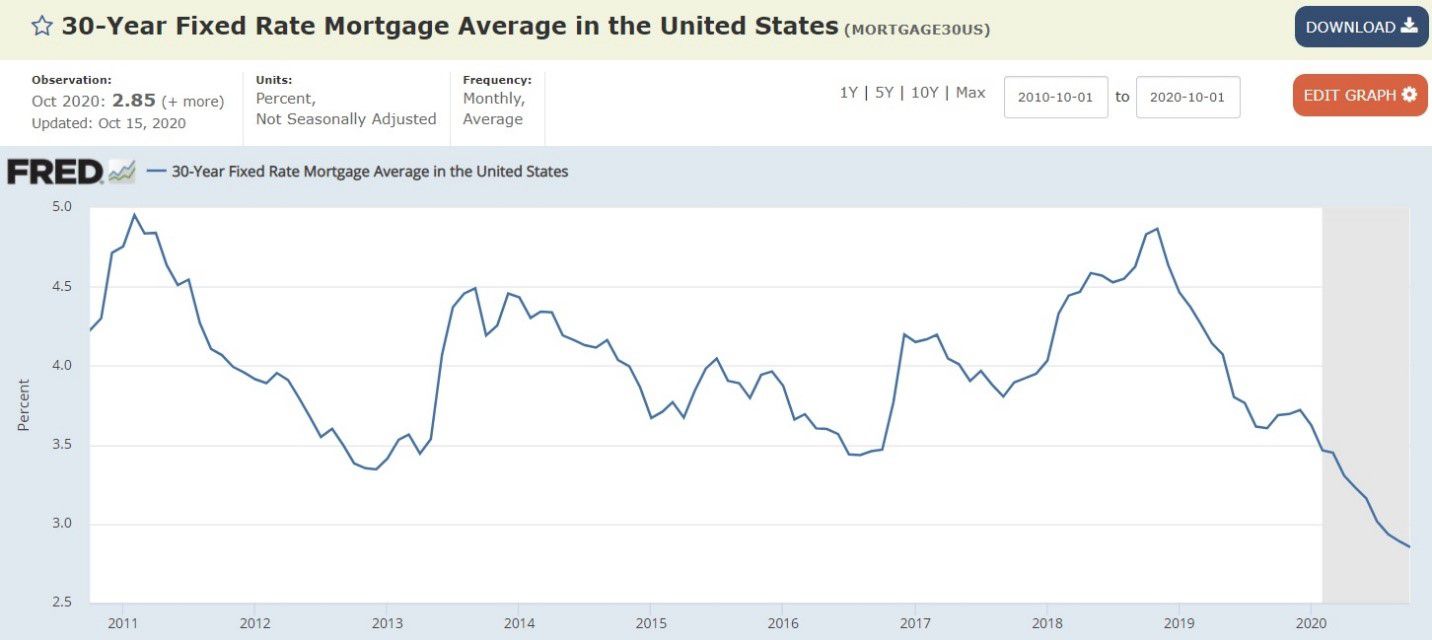

Interest rates on 30-year mortgages can vary based on a number of factors, including the current economic conditions, the lender, and the borrower’s credit score. The Federal Reserve sets interest rate targets, which can affect the rate offered by a lender. When the economy is strong and growing, Interest Rate on a 30 Year Mortgage tend to be higher, as lenders can charge more for the risk of lending money. When the economy is weak, interest rates tend to be lower, as lenders want to encourage borrowing.

The borrower’s credit score also plays a role in determining the Mortgage Affordability Calculator With Student Loans. A higher credit score typically results in a lower interest rate, as the borrower is considered to be a lower risk. On the other hand, a lower credit score may result in a higher interest rate.

In addition, the type of loan also impact the interest rate. A conventional loan, FHA loan, VA loan, and USDA loan all have different interest rates.

As of 2021, the average Interest Rate on a 30 Year Mortgage fixed-rate mortgage is around 3.1%. However, it is important to note that rates can fluctuate on a daily basis, so it is always best to check with a lender for the most current rates.

What is a 30-Year Fixed Mortgage?

A 30-year mortgage is a home loan that lets you repay your lender over 30 years—typically the longest repayment period a lender will allow and the most popular mortgage product. A 30-year, fixed-rate mortgage has an interest rate that never changes over the life of the loan.

Allowing borrowers to take 30 years to pay back a loan at a fixed rate makes homeownership much more attainable. Also, you always have the option to pay more toward your principal if you’re able to in a particular month or year. That can reduce the overall amount of interest you pay over the life of the loan.

Still, there are some downsides to a Interest Rate on a 30 Year Mortgage. By taking a longer period of time to repay your mortgage, you’ll pay more in interest costs. There are other mortgage products that have shorter terms, like 15 and 20 years. You can compare costs using a 15-year vs. 30-year mortgage calculator as an example.

How to Apply for a 30-Year Mortgage

Before you apply for a mortgage, review your credit profile and make any necessary improvements. To qualify for the lowest interest rate, your credit should be as strong as possible.

Then, calculate how much home you can afford, including how much of a down payment you can make. Part of this initial process should include shopping around for lenders to get an idea of rates and products that best fit you.

Mortgages are available through banks, credit unions and many online lenders. Find out what rates each lender is offering as well as the annual percentage rate (APR)—the total cost of a loan, including fees.

When you’re ready to apply for a mortgage, compile all necessary documentation like income verification, recent bank account statements and other proof of assets.

How to Get the Best 30-Year Mortgage Rates

Studies have shown that borrowers who comparison shop get better rates than those who go with the first lender they find. Financial experts recommend getting quotes from at least three different lenders. You may also want to consult a mortgage broker, who will shop around on your behalf.

If your credit profile isn’t strong enough for you to get the best mortgage rate possible, financial experts at your current bank, a housing counseling organization or a good mortgage broker can help offer tips on how to improve your score.

15-Year vs. 30-Year Mortgages

Getting a 15-year mortgage instead of a Interest Rate on a 30 Year Mortgage means you’re paying off the house in half the time. However, a 15-year mortgage typically has higher monthly payments because you’re paying down the loan more quickly. Rates on a 15-year mortgage tend to be slightly less than a 30-year mortgage.

Today’s average fixed rate for a 15-year mortgage is 5.66% compared to the average of 5.80% a week earlier.

If you have the means to make higher monthly mortgage payments, a 15-year mortgage might be a better option for you. In contrast, a 30-year mortgage might be better for someone who has a more limited budget or who wants to be able to save cash while making mortgage payments at the same time.

How (and why) to compare mortgage rates

Mortgage rates like the ones you see on this page are sample rates. In this case, they’re the averages of rates from multiple lenders, which are provided to NerdWallet by Zillow. They let you know about where Interest Rate on a 30 Year Mortgage today, but they might not reflect the rate you’ll be offered.

When you look at an individual lender’s website and see mortgage rates, those are also sample rates. To generate those rates, the lender will use a bunch of assumptions about their “sample” borrower, including credit score, location and down payment amount. Sample rates also sometimes include discount points, which are optional fees borrowers can pay to lower the interest rate. Including discount points will make a lender’s rates appear lower.

To see more personalized rates, you’ll need to provide some information about you and about the home you want to buy. For example, at the top of this page, you can enter your ZIP code to start comparing rates. On the next page, you can adjust your approximate credit score, the amount you’re looking to spend, your down payment amount and the loan term to see rate quotes that better reflect your individual situation.