Benefits of disability insurance provides partial income so you can take care of your bills if you become excessively ill or injured to work. Disability happens to additional individuals, surprisingly often. As a matter of fact, a larger number of disabilities are brought about by illness than injury, including normal conditions like coronary illness and arthritis, and most disabilities are not covered by Worker’s Compensation.1

A few managers will offer short and long-term disability benefits to their workers. A short-term policy helps you immediately after an incident, and a long-term policy gives financial protection to disabilities that can keep going for years. You can likewise pay for additional inclusion on top of the benefits you get at work to assist with providing extra financial protection.

What are the benefits of disability insurance?

Individuals may incorrectly expect what qualifies as a “disability.” For instance, they might believe the term applies to catastrophic conditions, like paralysis from an auto accident or a debilitating stroke. However, disabilities typically are the consequence of less extreme injuries and more normal conditions like pregnancy, back pain, depression, and digestive disorders.

An analysis of Guardian disability claims shows “psychological well-being,” which includes substance misuse, as one of the quickest developing diagnosis categories in the beyond five years, along with digestive and circulatory.

Social Security Disability Insurance Benefits

Studies show that a 20-year-old specialist has a 1-in-4 possibility becoming disabled before reaching full retirement age.

Who is eligible for Social Security Disability Insurance Benefits?

To be eligible for disability benefits, you should:

- Not be able to work since you have a medical condition that is supposed to endure something like one year or result in death.

- Not have a partial or short-term disability.

- Meet SSA’s definition of a disability.

- Be more youthful than your full retirement age.

If you qualify for disability benefits, certain individuals from your family might be eligible to receive benefits in view of your work record.

To find out if you might be eligible for Social Security’s benefit programs, look at SSA’s Benefit Eligibility Screening Instrument.

How much disability insurance do I need?

First, utilize your income needs as a guideline to determine your month to month benefit payout.

Then take a gander at the disability insurance offered through your work and determine if no more. By and large, you would be reimbursed around 40 to 60 percent of your pre-disability pay. A supplemental disability income insurance plan, either obtained through work or independently, can cover a portion of income that basic insurance may not.

Finally, the longer you are covered, the more you are paid. Also, a few professions have time limits. Office laborers can commonly be concealed to progress in years 65.

Short-Term and Long-Term Disability Insurance

If you can’t work since you are sick or injured, disability insurance will pay part of your income. You might have the option to help insurance through your boss. You can likewise purchase your own policy.

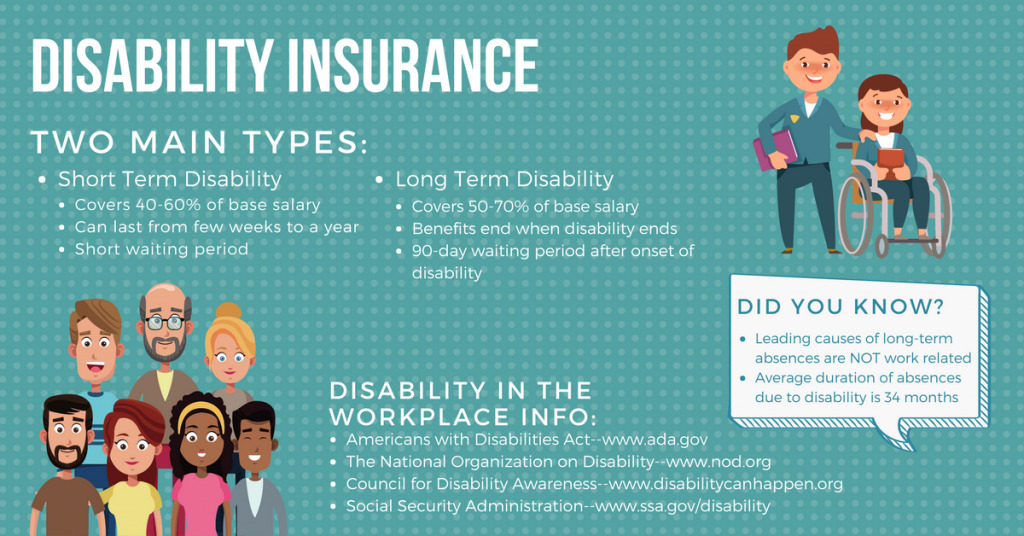

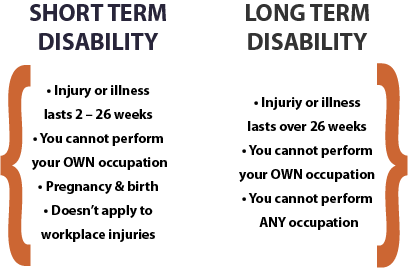

There are two kinds of disability policies.

- Short-term policies might pay for as long as two years. Most keep going for a couple of months to a year.

- Long-term policies might pay benefits for a couple of years or until the disability closes.

Bosses who offer inclusion might provide short-term inclusion, long-term inclusion, or both.

What are the three sources of disability insurance benefits?

At the point when you can’t work, there are three projects that can help: Social Security Disability Insurance, long-term disability and laborers’ comp. You might try and qualify for mutiple, however that can likewise cause issues.

They have a physical or mental impairment, and. the impairment has a substantial and long-term unfriendly impact on the individual’s ability to do typical everyday activities.

What are the most approved disabilities?

Arthritis and other outer muscle framework disabilities make up the most generally approved conditions for social security disability benefits. This is on the grounds that arthritis is so normal. In the United States, north of 58 million individuals experience the ill effects of arthritis.

For the most part, it takes about 3 to 5 months to get a decision. However, the specific time relies on how it requires to get your medical records and some other evidence needed to go with a choice. * How does Social Security settle on the choice? We send your application to a state office that settles on disability choices.