Calculator applies to private mortgages as it were. Results are inexact and for delineation purposes possibly; don’t depend on this information while making financial choices; visit your Mortgage Affordability Calculator With Student Loans in Canada or talk with a CIBC Mortgage Counsel.

Results depend on the information you give, evaluations and suppositions on which pre-filled sums are based, and interest rates which, for reasons for the estimation, are expected to remain consistent all through the term. Genuine rates might shift and will influence the sum you can acquire.

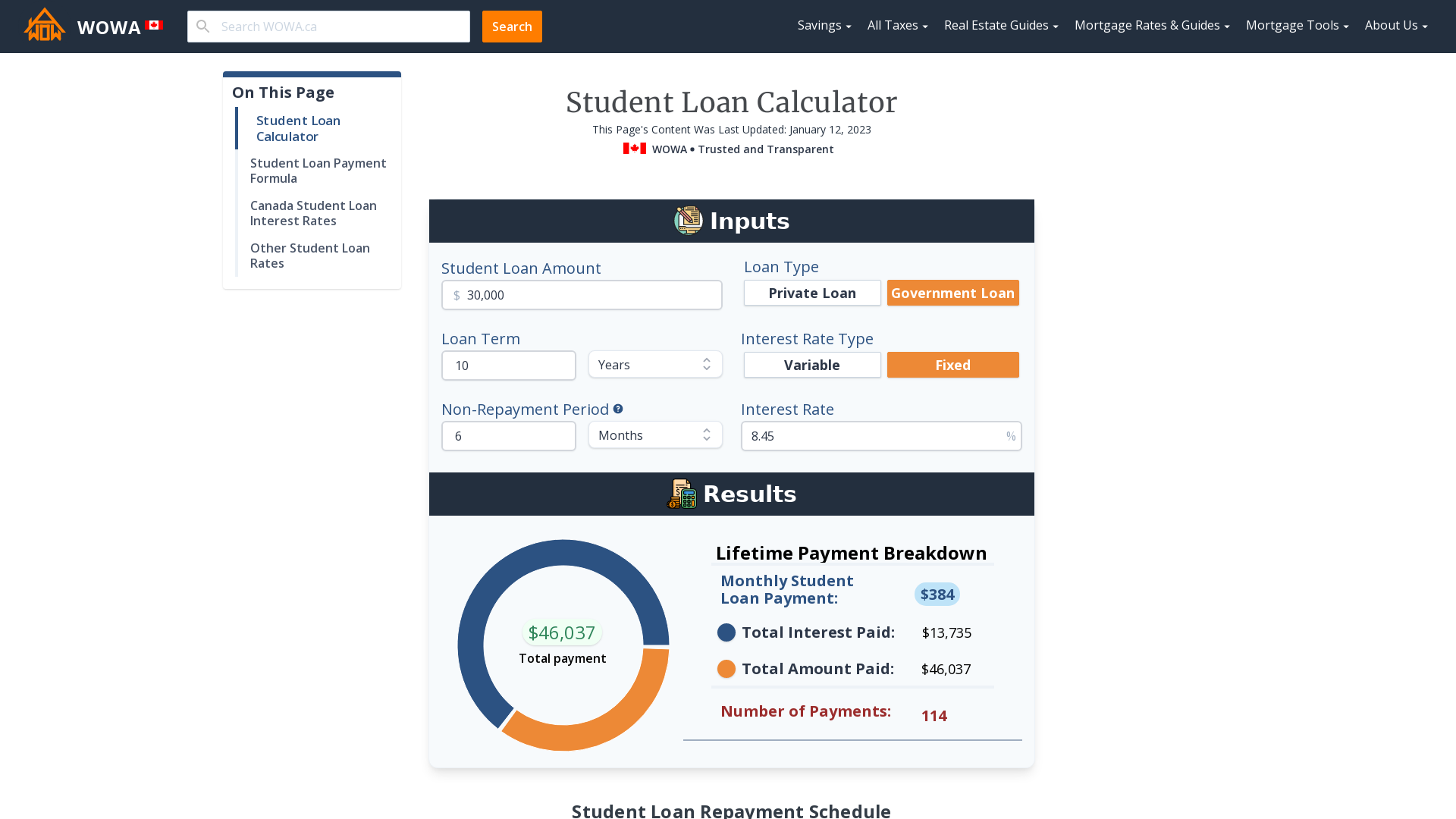

The most important phases in Obtaining a Personal Loan are ensuring you can stand to pay no less than 5% of the price tag of the home as an initial investment and determining your financial plan. This calculator steps you through the method involved with finding out the amount you can acquire. Fill in the section fields and snap on the installment plan button to see a total amortization timetable of your mortgage installments.

In the event that you are a first-time home purchaser looking at the right Mortgage Affordability Calculator With Student Loans in Canada, the housing market in most metropolitan regions continues to be valued so that it remains reasonable to those making a typical pay or above. The versatility of the commercial center throughout recent years combined with a genuinely decent economy have established the kind of climate that ought to urge you to take an interest by buying.

How much mortgage could I at any point manage?

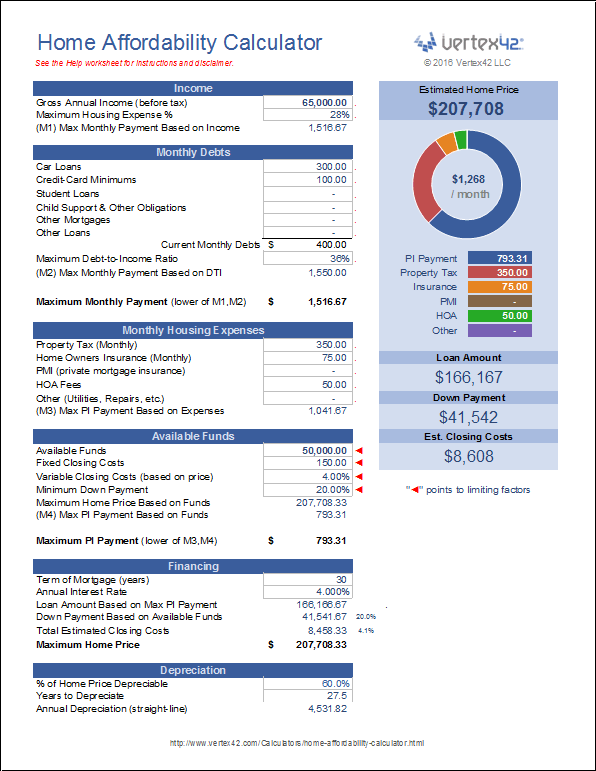

The most important phase in searching for your house is understanding how huge of a mortgage you can bear. With a couple of inputs, you can determine how much mortgage you might be OK with and the potential value scope of your future home. Knowing your all out family income, the amount you’ve put something aside for an initial investment, and your month to month expenses (vehicle installments, credit installment, living costs, etc), in addition to new costs you’d take on (local charges, townhouse expenses, utilities), you can get a sensible gauge. Dive deeper into factors that can influence your mortgage affordability.

Step by step instructions to assess affordability

To gauge mortgage affordability, loan specialists will utilize two standard obligation administration proportions: Mortgage Affordability Calculator With Student Loans in Canada (GDS) and All out Obligation Administration (TDS). According to the Canadian Mortgage and Housing Organization Note :

Rundown of 2 things

- GDS is the level of your month to month family income that takes care of your housing costs (including mortgage installments, apartment suite charges, utilities and duties). It ought to be at or under 35% of your pre-charge family income.

- TDS is the level of your month to month family income that takes care of your housing costs and some other obligations (including vehicle installments and other credit costs). It ought to be at or under 42% of your pre-charge income.

What your initial installment means for affordability

The sum you have put something aside for an initial investment is likewise one more significant snippet of information to assist with determining affordability. Depending on the price tag of a home, there are Mortgage Affordability Calculator With Student Loans in Canada for your up front installment.

Remember that assuming your initial investment is under 20% of the cost of your home, you’ll have to buy mortgage default insurance, which can be added to the principal measure of your mortgage.

Who Can Assist You In The Mortgage With marketing?

There are numerous loan specialists in Canada serving the mortgage market: banks, other enormous financial institutions and mortgage dealers. Most mortgage representatives in your town or city approach a wide scope of nearby and cross country loan specialists. A decent mortgage representative is regularly ready to place you into a program at a cutthroat rate.

Banks like the Bank of Nova Scotia are public and can likewise give prompt financing to your loans. By and by, nonetheless, most purchasers end up pre-qualifying with a bank or a realty institution through their realtor or mortgage representative. In that cycle, your necessities and prerequisites are thought about and coordinated with a bank that can offer the best support for you. At the end of the day, you might wind up with something else altogether holding your paper than when you began. However long the advance is supported and it meets your terms, you ought to feel sure about signing it.

The Most sweltering Business sectors

Vancouver is quite possibly of the most lovely city in North America. Its continued improvement as a significant center on the Pacific edge makes it be a magnet for investment from Asian nations. Originally, it was felt that Mortgage Affordability Calculator With Student Loans in Canada would settle there and there would be little else going on from Asia. Instead, the development that the city experienced pulled in others from a wide range of nations, keeping the housing areas of strength for market.

Toronto, obviously is one more enduring business sector champion in the vast majority of its midtown regions. The appeal, obviously, is that financially most businesses that are public keep some type of office here in light of the fact that the infrastructure gives such countless benefits. Luckily, there is still a lot of land in suburbia, allowing individuals to continue to fabricate the home of their fantasies whenever another improvement opportunity introduces itself.

What Occurs Assuming You Default?

A decade prior, there was a horrendous issue with individuals getting overstretched and defaulting on loans. The issue was that low factor interest rate loans energized examiners that got scorched when the rates increased as they attempted to move into a decent rate. The undeniable reality for those individuals was that they either wound up doing a short deal or having their homes dispossessed upon in light of the fact that in many housing markets the cost of homes shaply declined.

Today, when your Mortgage Affordability Calculator With Student Loans in Canada doesn’t match your advance, you are viewed as submerged. On the off chance that you owe more than your house is worth since it dropped in worth and you have a variable rate credit, you can not move it to a decent rate credit, leaving you with a miserable choice to make.