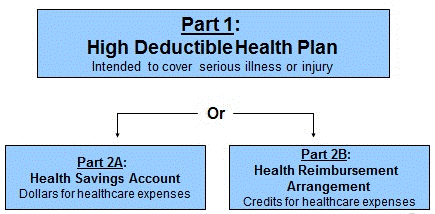

We will talk about What is a High Deductible Health Plan in this guide. The month to month expense is usually lower, however you pay more health care costs yourself before the insurance company starts to pay its share (your deductible). A high deductible plan (HDHP) can be combined with a health savings account (HSA), allowing you to pay for certain medical costs with cash liberated from federal taxes.

For 2022, the IRS defines a high deductible health plan as any plan with a deductible of at least $1,400 for an individual or $2,800 for a family. A HDHP’s total yearly personal costs (including deductibles, copayments, and coinsurance) can’t be more than $7,050 for an individual or $14,100 for a family. (This cutoff doesn’t apply to out-of-network administrations.)

A high-deductible health plan, also called a consumer-driven health plan, is health insurance with lower expenses yet higher personal costs when you want care. A HDHP can be any kind of health insurance plan, including a favored supplier organization (PPO) or health maintenance organization (HMO) plan. What separates it is its deductible.

How Does a High Deductible Health Plan Work?

HDHPs are intended to safeguard against catastrophic personal costs for covered treatment and administrations.

This is the way a HDHP works:

- You pay for all of your health care administration costs until you reach the plan’s in-network deductible.

- After reaching the deductible, you and health plan typically split the costs of health care administrations. That’s called coinsurance.

- You pay coinsurance until you reach the plan’s in-network personal maximum. At that point, the health plan pays the remainder of the health care costs when you gets administrations.

- We should take a gander at an example of how a high-deductible health plan works.

- In this example, suppose you have a high-deductible health plan with a $2,000 deductible.

- You reach the $2,000 annual deductible after a couple of visits to the doctor and an outpatient visit.

- That means you are currently ub the coinsurance time of the health plan. Suppose the health plan calls for you to pay 20% of health care costs while the health insurance gets the other 80%.

- The 20% of health charges rapidly gets you to the health plan’s personal cutoff after a hospitalization.

- When you reach as far as possible, you pay the expenses yet you don’t pay for further in-network care. The health insurance plan pays for those costs.

What Is a Health Savings Account?

You can often pair a HDHP with a health savings account (HSA). A HSA is a savings account that allows you to set pre-tax dollars aside to pay for qualified medical costs.

You can utilize HSA assets to pay deductibles, copayments, coinsurance and other health care costs. Charges typically cannot be paid for with HSA reserves.

You can contribute up to $3,650 into your HSA for individual coverage and up to $7,300 for family coverage annually. Your manager can also add to the HSA. Unspent HSA subsidizes turn over to the following year. Your HSA account may earn interest or other earnings, as well.

Combining a HDHP with a HSA gives three tax benefits: You can contribute assets into your HSA for a tax derivation, earn sans tax interest on the account and avoid being taxed for withdrawing HSA assets for qualified medical costs.

Pros and Cons Of a High-Deductible Health Plan

HDHPs have pluses and minuses. Take an opportunity to gauge these pros and cons carefully prior to choosing a high-deductible health plan.

HDHP pros

- You can save cash on lower charges in the event that you don’t require many health care administrations during the year.

- You can profit from tax advantages with a HSA attached to a high-deductible plan.

- A business may contribute assets to a HSA.

- You can take a HSA with you when you change occupations.

HDHP cons

- A HDHP can be more costly than anticipated in the event that you face startling medical bills and need to max out your annual personal costs.

- A deductible can be extremely high.

- HDHPs can be more costly assuming that you have many medical issues.

What Is a High-Deductible Health Plan in the ACA Marketplace?

The Affordable Care Act (ACA) marketplace (also known as Obamacare) offers plans across four metal levels: Bronze, Silver, Gold and Platinum. These plans contrast in how much you pay for charges and personal costs when you really want care.

Silver and Bronze plans usually have lower expenses and higher deductibles and personal costs, making them qualified as HDHPs. Gold and Platinum plans generally have low deductibles and higher charges and don’t qualify as a HDHP.

How Much Do High-Deductible Health Plans Cost?

Individuals with a Bronze plan from the ACA marketplace pay an average of $928 a month for an unsubsidized plan, while a Silver plan costs $1,217 on average month to month. ACA marketplace health insurance expense costs vary based on different factors, including age, plan type, where you live, health insurance company and smoking use.

Here are the average unsubsidized costs for Bronze and Silver plans on the ACA marketplace, which often qualify as HDHPs.