With base interest rates at all time lows and the quantity of arrangements on offer, finding all that mortgage can be a truly challenging and time consuming cycle. We assist you with finding the best mortgage bargains in light of your requirements and individual circumstances – saving you time and cash all the while. Whether you are a first time purchaser, looking to remortgage or buy a purchase to-let property, we contrast the market with get you the most ideal arrangement. We work with the Borrow Mortgage Calculator Ireland and our service is 100 percent free.

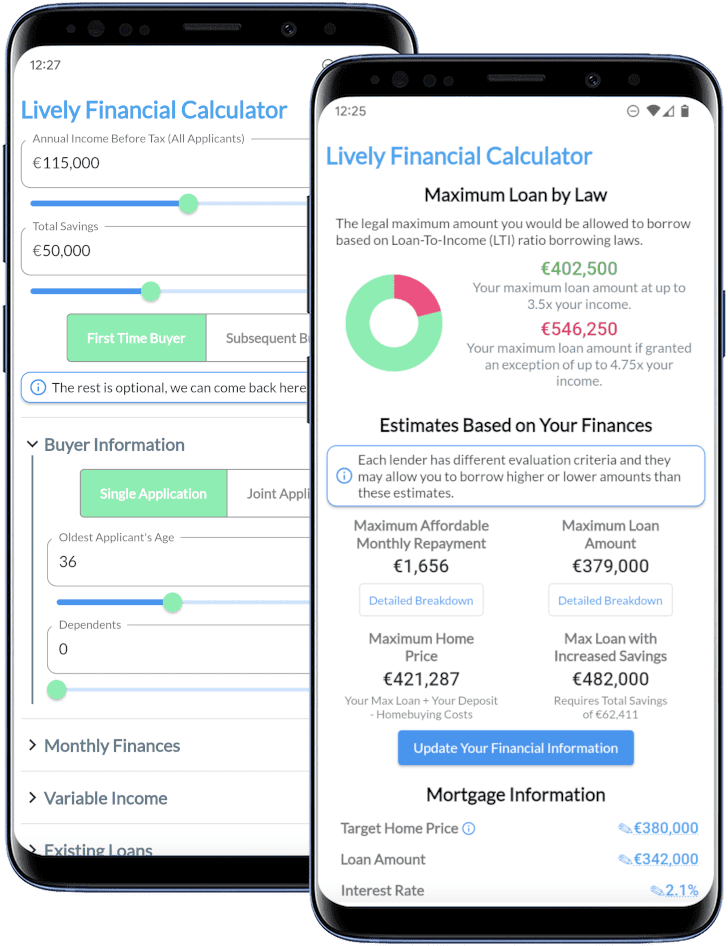

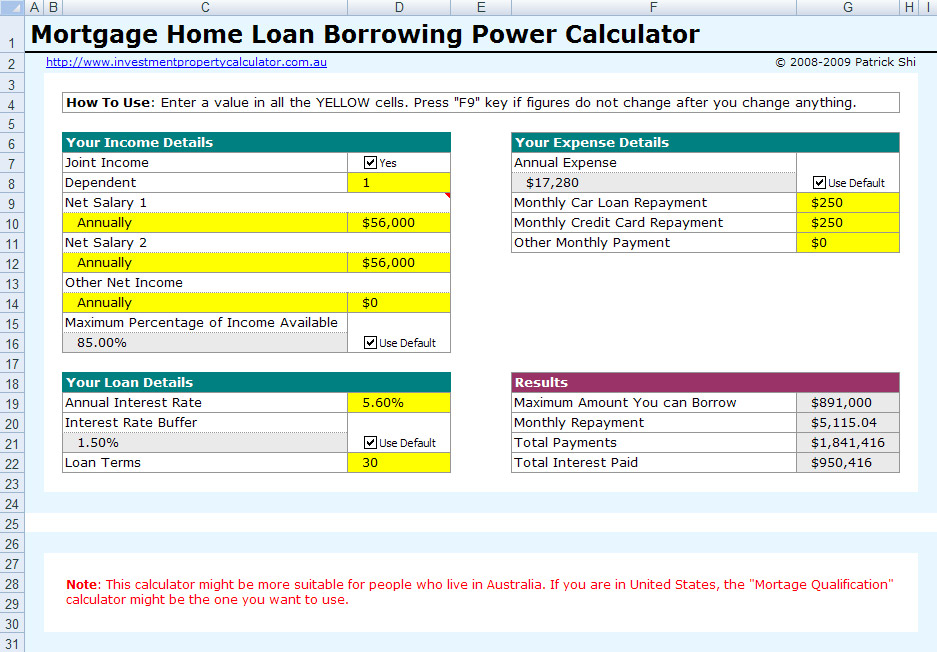

Enter your details in the mortgage calculator to estimate the maximum mortgage you can borrow. Subsequent to performing the calculation, you can move the outcomes to our mortgage comparison calculator where you can analyze all the most recent mortgage rates.

Utilize our mortgage reimbursement calculator to estimate your month to month reimbursements or ascertain how much you can borrow against term life insurance. Our quick and simple mortgage calculator additionally displays how much cashback you could get when you drawdown your mortgage.

Allow Us To think about Mortgages for You

Comparing mortgages is simple with Borrow Mortgage Calculator Ireland. All if you are befuddled or have no clue about the ongoing mortgage rates, interest rates, fixed versus variable and money backs incentives from Ireland’s loan specialists then, at that point, get in touch with us.

Our Mortgage Calculator Ireland allows you to examine the best mortgage rates available from all moneylenders we work with. You can think about and work out different mortgage rates, throughout different time periods.

The calculator can be utilized to get to how much you can borrow, how much you will require for your deposit, and how much you can save by refinancing or switching mortgages. Converse with us on a web talk, via telephone or book an appointment with us.

Get mortgage endorsement in principle and starting searching for your fantasy home. We will assign you a dedicated financial advisor that will assist with every one of your necessities. So whether you are a first-time purchaser or mortgage switcher, you’ll benefit from using our Mortgage Calculator Ireland instrument.

How much can you borrow?

First time purchasers maximum Borrow Mortgage Calculator Ireland is 4 times your gross yearly income with the mortgage covered at 90% of the price tag.

For instance, if your gross compensation is €80,000, the maximum mortgage would be €320,000. This calculator gives you an estimate of the maximum sum you will have the option to borrow.

Second time purchasers maximum mortgage is 3.5 times gross income with a cap likewise of 90% of the price tag,

We anticipate looking after you

Most home purchasers utilize a combination of mortgage facilities and savings or help to purchase plans to purchase their new home.

First time purchasers can take out a mortgage of up to 90% of the price tag of a home.

While arranging mortgages we want to satisfy moneylenders that can easily manage the cost of the reimbursements on the mortgage. In such manner we take a gander at evidence of consistent savings and furthermore history of rental installments.

Costs associated with getting a mortgage

Mortgage adviser expenses – Around here at Borrow Mortgage Calculator Ireland we don’t charge business charges to home purchasers

- Stamp Obligation 1% of the price tag

- Legitimate Expenses €2,500 A typical spending plan including various charges and obligation

- Valuation expenses €150

- Assessor expenses €400 – Not necessary yet highly suggested

What influences how much you can borrow?

There are a few things that influence how much you can borrow in Ireland. Here is the main factors that banks consider while assessing your Borrow Mortgage Calculator Ireland application.

- The sort of mortgage you need: for example first time purchaser, self build, purchase to let, terrible credit and so forth.

- The kind of borrower you are: for instance if you’re a first time purchaser, switcher, home mover or purchase to let investor.

- Your income: or combined income if another person is applying for the mortgage with you.

- Your age: If you’re a more seasoned borrower, this might limit your mortgage term, and hence, how much you can borrow.

- Number of dependants: If you have children under 18, a portion of your income will be utilized to help them.

- Your existing credit commitments, for example, advances, credit cards, overdrafts, hire buy arrangements or vehicle finance.

- Other month to month outgoings: for example childcare costs, family bills and insurances.

- Your credit history: and how responsibly you have repaid advances and credit before. This is the way to check your credit record for nothing.

Who sets the borrowing limits in Ireland?

The National Bank of Ireland is responsible for borrowing limits. Moneylenders keep National Bank borrowing guidelines, known as mortgage measures, which sets the Advance to Esteem (LTV) and Credit to Income (LTI) limits.

These mortgage apportions were set in 2015 and refreshed in 2023 to help:

- Guarantee banks loan responsibly

- Guarantee you borrow what’s reasonable

- Keep the economy stable

These actions are reviewed every year, and might be changed if required, to maintain a steady economy in Borrow Mortgage Calculator Ireland .