The time it takes for Halifax Take To Release Mortgage Funds can vary based on several factors such as the type of mortgage, the documentation provided, and the complexity of the case. On average, it can take anywhere from 2 to 4 weeks for Halifax to release mortgage funds.

It is ordinarily realized that various banks have fluctuating help assumptions to release funds, however, in this aide, we will examine the distinctions in the quantity of days those particular banks take to release mortgage funds. We will likewise examine the significance of practicality while managing monetary exchanges and the outcomes of a deferral.

It’s where you sign a contact consenting to purchase a house and the merchant signs an mortgage loan modification agreement consenting to offer the house to you. Then your conveyancers “trade” these agreements. This is the stage when you’ll pay your store.

By marking the agreements, you’re committed by regulation to purchasing the property. When the agreements have been traded, the purchaser and merchant can’t retreat. The trade can happen once your store is set up and all set. By this stage, you’ll have endorsement for your mortgage.

He had passed various Halifax Take To Release Mortgage Funds at each stage and they consented to release the funds next Tuesday, just to be told by his mortgage counselor that they had pulled out after another FICO assessment. He has checked every one of the 3 credit report sites and nothing has changed. He has no obligation, no late installments of all time.

What is Halifax

Halifax is the capital city of Nova Scotia, Canada. It has a rich history, dating back to its founding as a British military base in 1749. The city played a significant role in World War I and II, and its deep-water harbor has made it an important center for shipping and trade.

Today, Halifax Take To Release Mortgage Funds is a vibrant, growing city with a diverse economy, including a strong financial sector, as well as industries such as technology, film production, and tourism. The city is also known for its scenic beauty, including its harbor and nearby parks and beaches, and its vibrant arts and culture scene.

What Type of Mortgage Dose Halifax Offer

Halifax offers the following types of mortgages:

- Fixed rate mortgage: the interest rate is fixed for an agreed period, typically 2 to 5 years, giving you the peace of mind of knowing exactly what you’ll be paying each month.

- Tracker mortgage: the interest rate is linked to the Bank of England base rate, so if it goes up or down, your mortgage payments will follow.

- Discounted rate mortgage: a discounted rate is applied to the lender’s standard variable rate for an agreed period, typically 2 to 5 years.

- Offset mortgage: a savings account is linked to your mortgage, and the balance in the savings account is offset against the mortgage balance, potentially reducing the interest you pay on the mortgage.

- Flexible mortgage: offers features such as overpayments, underpayments, and payment holidays, allowing you to have more control over your mortgage payments.

- Buy to let mortgage: designed for those looking to purchase a property to rent out to tenants.

- Self-build mortgage: a mortgage specifically designed for those looking to build their own home.

- Shared ownership mortgage: designed for those who cannot afford to purchase a property outright, allowing you to buy a share of a property and pay rent on the remaining share.

It is important to note that the options available to you may vary depending on factors such as your location, deposit size, and personal circumstances.

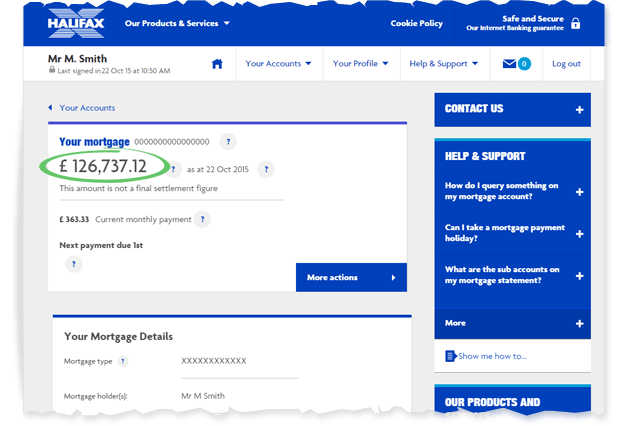

How are mortgage funds released?

Mortgage funds are released on the day the mortgage holder legitimately turns into the proprietor of the property, on the consummation date of the Halifax Take To Release Mortgage Funds. The average cycle includes the chosen solicitor drawing the mortgage funds from the moneylender in front of consummation, to guarantee that cleared funds are accessible for the finishing date. Solicitors frequently permit additional chance to guarantee that the funds are gotten in time, maybe mentioning the funds from the mortgage supplier three working days in front of fulfillment.

When cleared funds are prepared the solicitor will make the installment for the property to the merchant’s solicitor and consequently, get the title deeds to finish the cycle. Every exchange should be actioned promptly, permitting time for the funds to clear.

Frequently every exchange will include moving an enormous amount of cash between banks by means of a particular kind of bank move called a CHAPS, which represents the Clearing House Automated Installment Framework. There are charges for utilizing the CHAPS administration, normally somewhere in the range of £20 and £35 per exchange.

How does trade of agreements and finish work?

The trading of agreements will be dealt with by your solicitor. Before the trade can occur, you’ll have to ensure the accompanying:

- The loan specialist’s valuation has been completed

- You have a mortgage offer from your loan specialist

- You’ve concurred what’s remembered for your deal (apparatuses and fittings, furniture)

- You’ve marked your duplicate of the agreement

- Your solicitor has moved your store

When that is completely done, you can trade contracts. On the off chance that you’re purchasing a house, this is the thrilling piece. You’ll be given a moving in date not long after this point.

You should orchestrate structures insurance for your new home before the trading of policies. This covers against the expense of harm to your new home from things like flames and floods.

Summary

Here, we have investigated the cycle engaged with delivering mortgage funds while buying property, including the ordinary span of time this takes for explicit banks and the Halifax Take To Release Mortgage Funds. We have likewise momentarily covered the checks expected to permit solicitors to meet enemy of illegal tax avoidance regulation. Would it be a good idea for you have any questions in regards to acquiring a mortgage, the mortgage cycle, or hostile to tax evasion regulation, kindly do reach out to our well disposed group for additional counsel.