Investment is prevalently in values. The quantity of value property will commonly run somewhere in the range of 50 and 100 and the portfolio can be moderately focused. An unconstrained methodology is taken on and there are no decent cutoff points set as to geological, industry and area openness. The Scottish Mortgage Investment Trust will be held in cited values with great liquidity. Investment may likewise be made in fixed revenue protections, convertible protections, reserves, unquoted substances and different resources in view of the singular investment case.

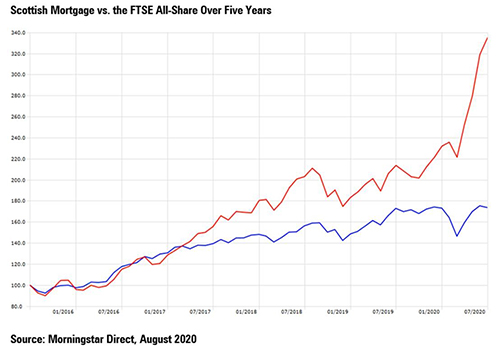

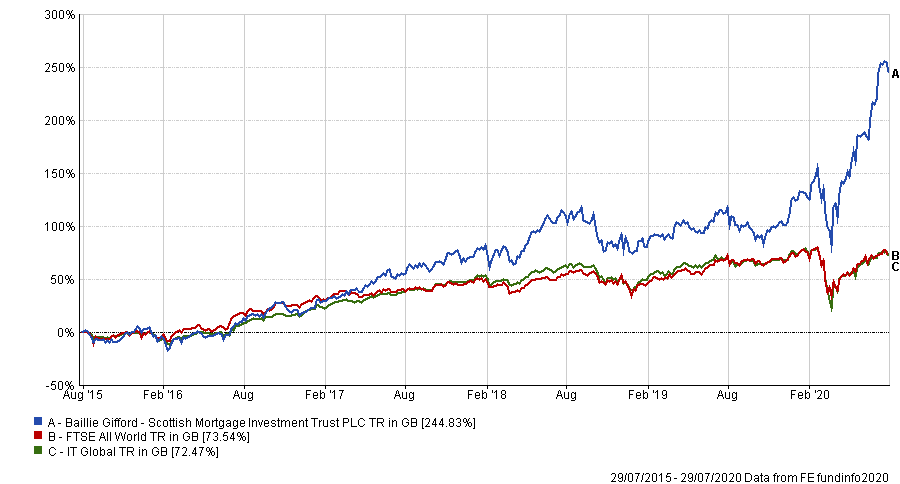

The greatest sum which might be put resources into organizations not recorded on a public market will not surpass 30% of the all out resources of the Organization, estimated at the hour of procurement. The Organization means to accomplish a more noteworthy return than the FTSE All-World File (in real terms) north of a long term moving period or longer.

The Trust holds back nothing from a worldwide arrangement of at first youthful enterprising organizations, ordinarily with a market capitalisation of under $5bn at season of starting investment, which are accepted to offer long haul development potential.

Scottish Mortgage Investment Trust is one of the most well known pay off mortgage calculator uk. However, it hasn’t performed well in 2023. Here, I will survey SMT’s 2022 exhibition. I’ll examine whether, as a holder, I would purchase more offers for 2023 and then some.

Strangely, Scottish Mortgage Investment trust has no specific spotlight on Scottish investments and nothing to do with mortgages. Its name originates from its long history, which dates to 1909. Nowadays, the trust ordinarily holds somewhere in the range of 50 and 100 organizations around the world, joined by areas of strength for them possibilities. The chiefs have a patient purchase and-hold approach and mean to boost complete returns – for example both pay and capital development – for investors over the long haul. This asset regularly has low turnover.

Our perspective

Scottish Mortgage Investment trust is an effectively overseen trust, with a fortunate long haul history. Store supervisors Tom Slater and Lawrence Consumes adopt a high conviction strategy and can contribute up to 30% of the portfolio in unlisted organizations. In view of this, Scottish Mortgage Investment trust may not be suitable for lower risk financial backers. Nonetheless, for those looking for openness to higher development possibilities around the world, this trust is a very much overseen choice that spotlights on tracking down the upcoming victors. It is likewise seriously estimated, with a low continuous charge and no exhibition expense as the group accepts it subverts investment execution.

Trust chief

Investment firm Baillie Gifford oversees Scottish Mortgage Investment trust. Established in 1908 and representative possessed, the firm is situated in Edinburgh and has workplaces in London, New York and Hong Kong. It has an organization structure, which has empowered it to hold key individuals. The organization has a fantastic record of corporate security, which has added areas of strength for to execution.

Following the retirement of James Anderson in April 2022, the trust is currently overseen by Tom Slater and Lawrence Consumes. Tom burned through five years as delegate administrator of the Scottish Mortgage Investment trust prior to becoming co-lead in January 2015 and afterward lead director in April 2022.

Lawrence turned into a delegate supervisor on the trust in Walk 2021, becoming co-chief in April 2022. Lawrence joined Baillie Gifford in 2009 and starting around 2017 he has co-dealt with the worldwide concentrated development technique. Both Tom and Lawrence are accomplices at the firm.

Investment board

The board includes five individuals and is led by Fiona McBain, the previous CEO of Scottish Amicable Affirmation. Prior to joining Scottish Cordial in 1998, she functioned as a contracted bookkeeper at Prudential and Arthur Youthful (presently Ernst and Youthful).

The excess board individuals are Justin Dowley, Teacher Patrick Maxwell, Dr. Paola Subacchi and Amar Bhide. Between them, they have different foundations in business and monetary administrations, carrying a pool of master information to the board. They meet six times each year, and Scottish Mortgage Investment trust has a year-end of 31 Walk.

Investment process

Tom and Lawrence are notable for their style of development contributing. They plan to distinguish organizations which can possibly disturb their own enterprises, with feasible plans of action more than five years. Thus, the portfolio will in general have a moderately high designation to innovation organizations. They center around the drawn out capability of a business as opposed to its ongoing worth. In the most natural sounding way for them, they “own organizations as opposed to lease shares”. The administrators additionally attempt to try not to gauge the course of business sectors or economies.

Would it be advisable for me to purchase more SMT for 2023?

So would it be advisable for me to purchase more offers in the trust? Indeed, as a drawn out financial backer, I actually believe there’s a great deal to like about SMT.

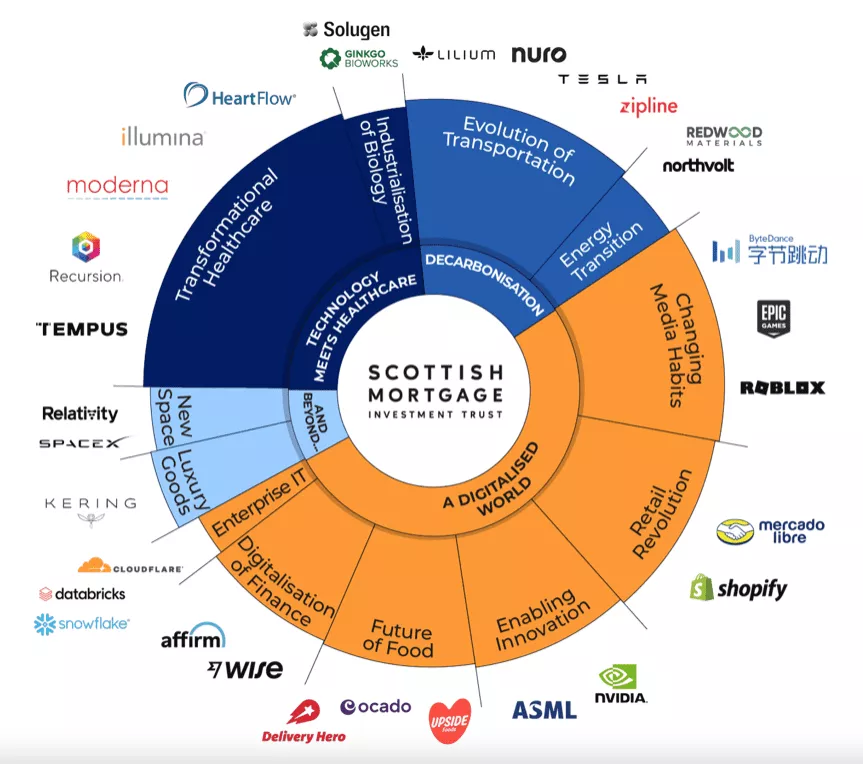

First off, it gives me openness to strong subjects and patterns including:

- Decarbonisation

- Advanced change

- The advancement of transportation

- Medical services development

These are patterns I need openness to. They are probably going to set out numerous investment open doors in the years to come.

Furthermore, it gives openness to creative organizations like Tesla, Nvidia, Moderna, Snowflake, Roblox, and Insightful.

A ton of these stocks are higher gamble, so I wouldn’t get them exclusively. In any case, I’m glad to claim them as a component of a differentiated investment trust.

Should you invest £1,000 in Scottish Mortgage right now?

While effective financial planning master Imprint Rogers has a stock tip, it can pay to tune in. All things considered, the lead Diverse Dolt Offer Counselor pamphlet he has run for almost 10 years has furnished a huge number of paying individuals with top stock suggestions from the UK and US markets.

Imprint and his expert group just uncovered what they accept are the 6 best stocks for financial backers to purchase at the present time… furthermore, Scottish Mortgage wasn’t on the rundown. At the present time, they think there are 6 stocks that are better purchases!

Would it be advisable for you contribute, the worth of your investment might rise or fall and your capital is in danger. Prior to effective financial planning, your singular conditions ought to be surveyed. Think about taking free monetary exhortation.