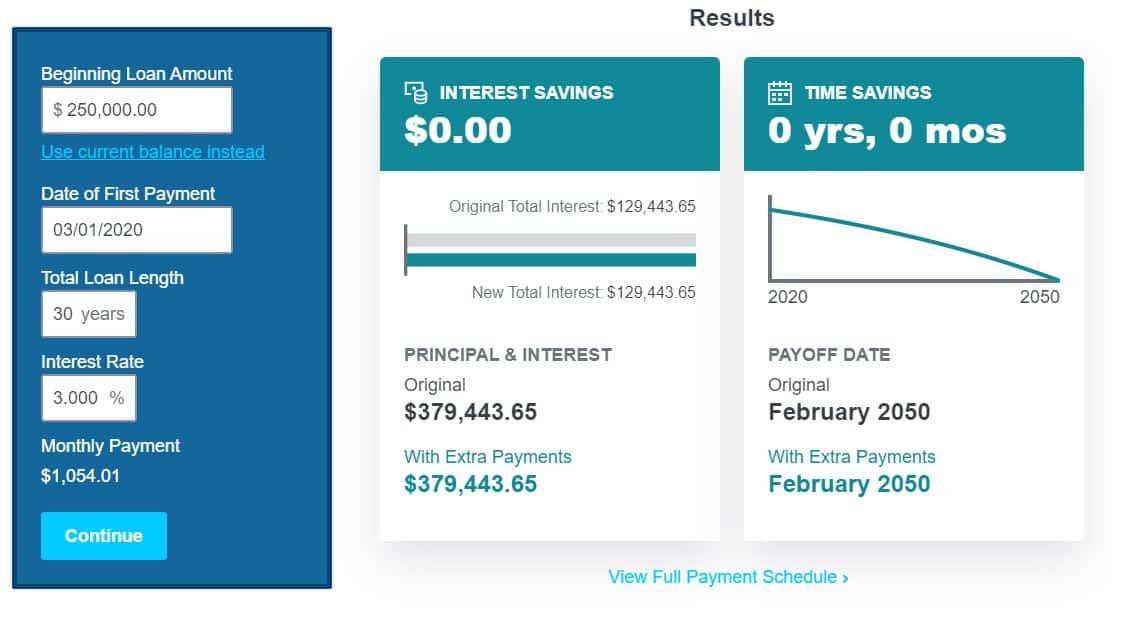

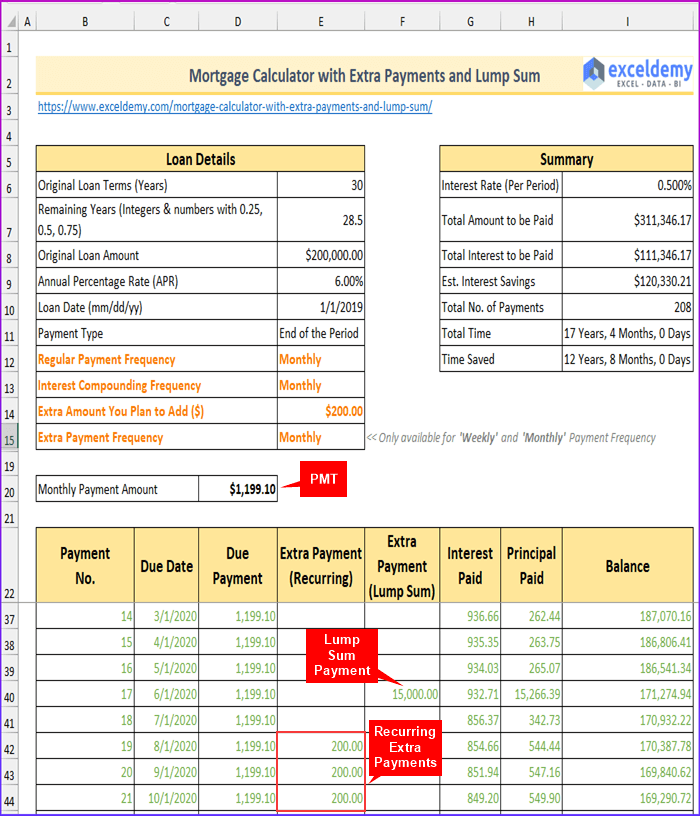

With regards to mortgages, the issue of how much you can manage the cost of as far as the repayments is similarly just about as significant as how much the mortgage supplier will loan you. Our speedy Pay Off Mortgage Calculator UK will give you a smart thought regarding how much you will be supposed to repay each month. Kindly note, the calculator is planned to give a sign as it were. You may likewise be keen on computing how much you could get for a mortgage.

The mortgage overpayment calculator is for illustrative purposes and doesn’t consider any overpayment limitations or Early Repayment Charges. The calculator likewise expects the mortgage rate utilized will apply for the term expressed and can’t represent future changes to loan costs or your item.

On top of that, a decent second step is to check FICO ratings and raise any problematic negative imprints with the broker that gives the Pay Off Mortgage Calculator UK. Expecting great credit in the UK, it is feasible to get with a somewhat little initial investment. There are many mortgage credit items requiring stores of 5% or less of the property estimation, however it can change as needs be with economic situations.

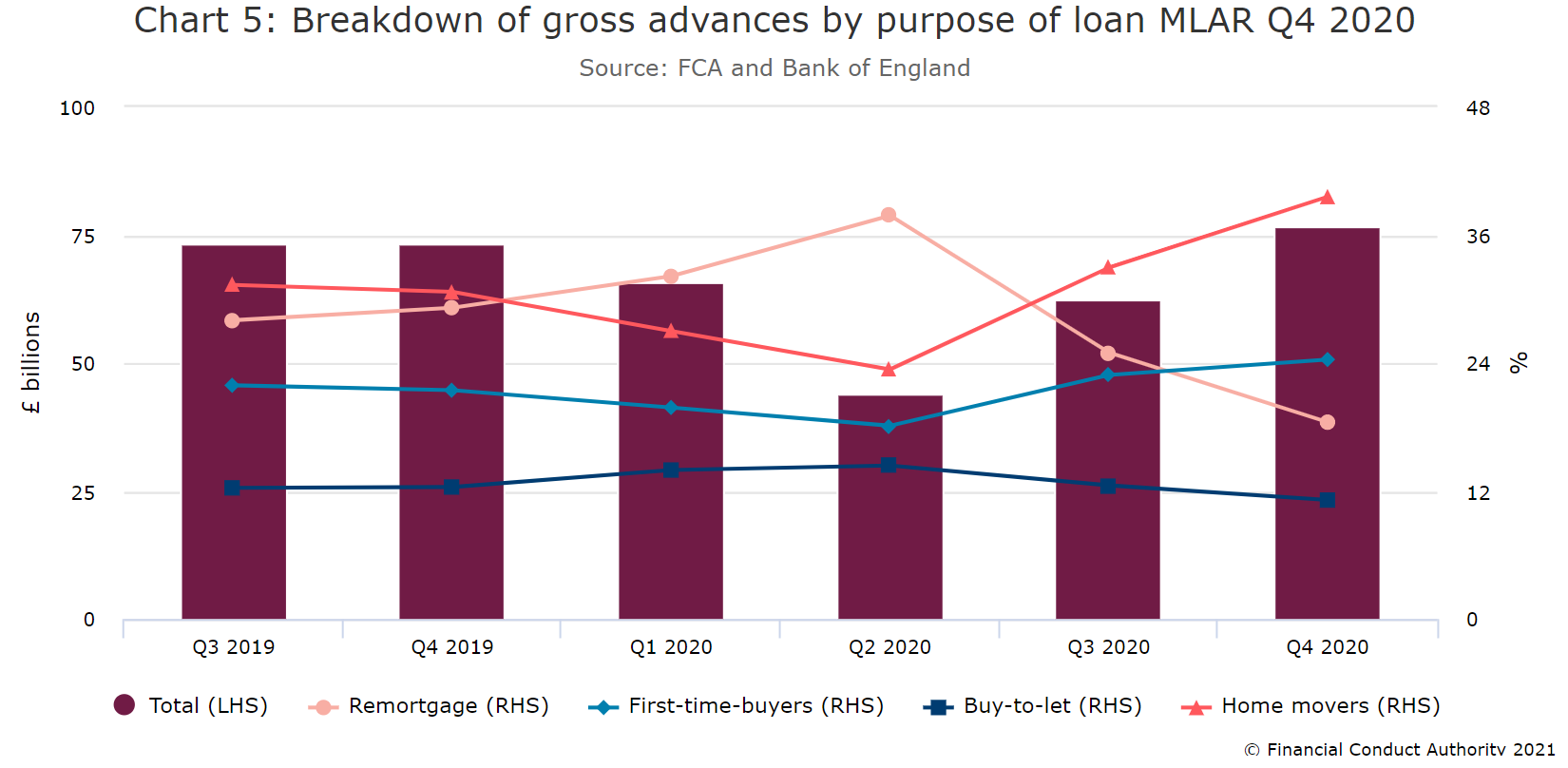

Any reasonable person would agree that a considerable lot of us fantasy about paying off our mortgages early, despite the fact that whether it’s the most ideal choice for you relies upon various factors. With the typical mortgage term being 25 years, even with a low loan cost each time you remortgage, you’ll in any case have paid tens, or even a huge borrow against term life insurance of pounds in interest alone.

How to pay off your mortgage quicker

- Abbreviate your mortgage term

- Overpay your mortgage

- Remortgage

- Pay charges forthright

- Abbreviate your mortgage term

Shortening your mortgage term implies promising your bank you will pay back what you owe in a more limited timeframe.

This is the secret:

You take out a £200,000 Pay Off Mortgage Calculator UK with a 3-year fixed pace of 2.5% north of a 25-year term. Toward the finish of three years, you’ll have 22 years left on the mortgage, have reimbursed some interest, despite everything owe £188,187.

As of now, you could absolutely get the least expensive 22-year mortgage you can find. Or on the other hand, you could get a mortgage with a 20-year term all things considered.

By shaving 2 years off the term, your regularly scheduled payments would increment from £928 to £997. However, you would save £5,522 in revenue over the term of the mortgage (expecting you change to another mortgage manage a loan fee of 2.5% like clockwork).

Overpay your mortgage

Overpaying your mortgage is the point at which you pay more than the necessary sum, every month, and can assist you with paying off your Pay Off Mortgage Calculator UK a whole lot earlier. You possibly benefit assuming your bank permits overpayments on your specific mortgage. If not, you might need to pay a charge.

For instance, you take out a £200,000 mortgage with an underlying loan fee of 2.5%. Accepting your loan cost stays at 2.5% (for example you hold changing to another special arrangement at regular intervals) your month to month repayments will be £897 and you’ll be sans obligation following 25 years.

Remortgage

Except if you remortgage to less expensive arrangements all through your mortgage term, you’ll ultimately wind up on your loan specialist’s standard variable rate (SVR).

The regular SVR is right now around 3.57% though the normal 2-year fixed rate mortgage is 1.42%. This implies when your two-year fixed rate bargain gets done, you’ll be charged more revenue.

For instance, say your mortgage is £200,000 and fixed at 1.42% for quite a long time on a 25-year term. Following 3 years, you return to your bank’s 3.57% SVR – and recollect, variable rate mortgages can go up or down.

Get an offset mortgage

At the point when you come to remortgage, you could profit from an offset Pay Off Mortgage Calculator UK. An offset mortgage gives a connection between your investment account and your mortgage with a similar moneylender.

Your money reserve funds are offset against the size of the extraordinary home advance, so you’ll pay less in revenue.

For instance, you have a £200,000 mortgage and £10,000 in reserve funds. Here, your £10,000Switch to block editor ‘connected’ reserve funds diminish your mortgage by a similar sum, meaning your obligation goes down to £190,000 (£200,000 short £10,000).

As regularly scheduled payments are normally worked out all in all obligation (£200,000), you’ll pay less interest and overpay your mortgage without punishment, meaning you could pay it off sooner.

Pay charges forthright

Mortgages with temptingly low loan costs publicized can frequently accompany high charges, which can be essentially as high as £2,000. It’s not unexpected to attach these expenses on to the mortgage add up to try not to need to pay them forthright.

In doing this, you possibly diminish your possibilities paying off your Pay Off Mortgage Calculator UK, on the grounds that your month to month repayments will increment.

However, in the event that you can pay the charges in a single amount toward the beginning of your mortgage, you’ll pay less interest generally speaking and are bound to be in a situation to overpay (inside the cutoff points set by your loan specialist) and pay off your mortgage early.