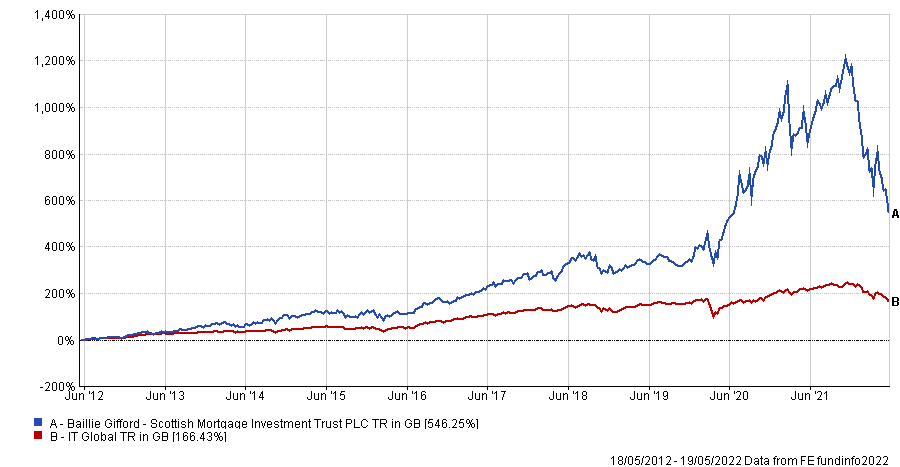

It’s likely this trust highlights in a considerable lot of our perusers’ portfolios and it has been a winning wagered for a significant part of the previous ten years. At a certain point, the offers were up 1,000% on our price tag, making it a vital contributor to the 17% yearly return the portfolio achieved among send off and the Scottish Mortgage Investment Trust. As the trust has taken off in esteem over the course of the past 10 years, we’ve resisted the temptation to take profits mainly as a support against being incorrectly.

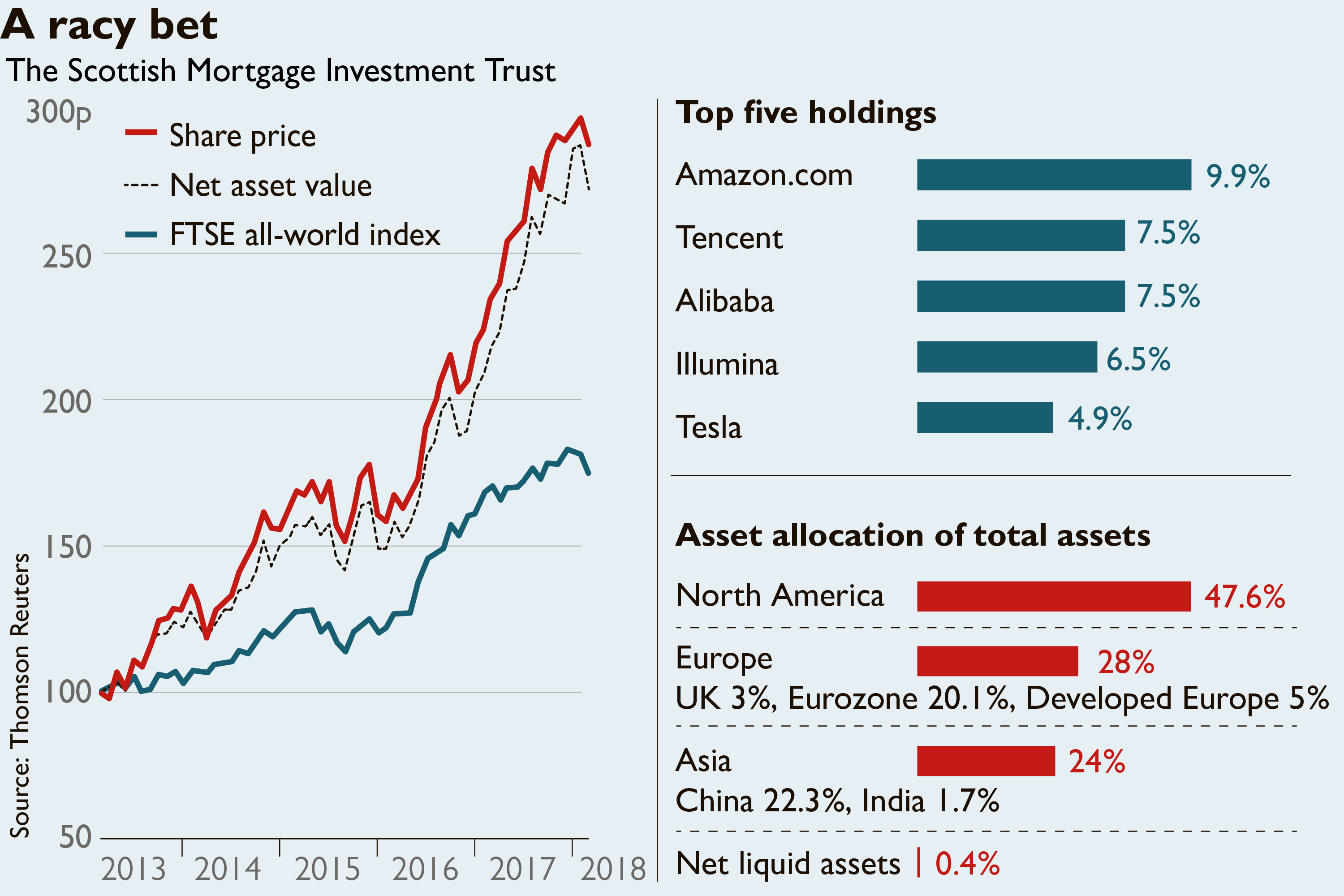

Scottish Mortgage Investment Trust shares are one of the most mind-blowing ways of gaining openness to development stocks as a British investor. What’s more, can we just be real for a minute, the FTSE isn’t precisely filled with exciting learning experiences.

The publicly exchanged investment private label mortgage backed securities centers heavily around development and tech stocks, a large number of which are listed in the US and China. Development stocks, by and large, didn’t perform well in 2022. Also, that is reflected in the falling Scottish Mortgage share price. The SMT share price mirrors the worth of its holdings.

It’s fair to say that Scottish Mortgage Investment Trust exhibition in 2022 has been disappointing. Toward the beginning of the year, SMT’s portion price was 1,338p. Be that as it may, as I write (on 21 December), it’s 720p. That addresses a decline of around 46%. Oof!

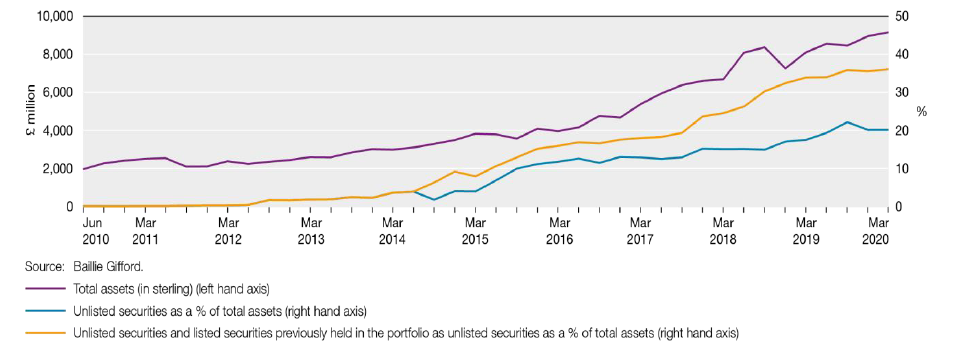

Shares in Scottish Mortgage Investment Trust (SMT) are somewhere around one third in esteem throughout the course of recent months at 746.6p, having offered off because of the impact of high inflation and rising interest rates on lengthy duration resources including the ‘world’s most exceptional development companies’ it invests in. Scottish Mortgage turned into an investor favorite in the wake of delivering a staggering net resource esteem.

Scottish Mortgage Trust’s time of lackluster showing

Previously oversaw by star Baillie Gifford store supervisor James Anderson, who was responsible for the re-engineering of the trust and its emphasis on development stocks, Scottish Mortgage needed to manage both a director transition and market volatility last year.

Its lead investment director is Tom Slater, who assumed control over the steerage last year, and has admitted that 2022 was a “humbling year” for the firm.

At an investor occasion toward the beginning of January, Slater let investors know that while Baillie Gifford loathes “losing our investors’ cash” misfortunes of the sort seen last year are “inevitable result of the manner in which we deal with the trust.”

Scottish Mortgage Investment Trust is a development investment trust, and as its profits show, this approach can be highly lucrative. However, it accompanies its difficulties, outstandingly the way that development stocks can be exceptionally volatile.

A great deal of investors battle with development investing for that very reason – they can’t stand the promising and less promising times of market gyrations.

It requires some investment to grow an organization and patience with respect to investors, which is something the trust’s chiefs are very much aware of.

Scottish Mortgage is looking to exploit the volatility

In November, the supervisors contended “innovation is effectively today on special,” and they appear to have a similar point of view today.

At the January investor occasion, Slater noticed that a considerable lot of the holdings in the portfolio are presently less expensive than they were before the pandemic. Some haven’t been less expensive since the lows of the 2008 financial crisis.

“This isn’t to imply that they can’t go less expensive. Who can say for sure where markets will go for the time being, however the starting point is interesting. Looking at our main 10 holdings, they have gone from a typical deals multiple of seven times to around five times in a year. That is a 30% fall in the worth of the resources, which has little to do with their drawn out potential,” he noted.

With development companies, it’s the drawn out potential that is important, not momentary offer price developments.

“We have a bunch of companies here that are relatively right off the bat in their useful learning experience, from Moderna in medical care, through to how early we are in the penetration of electric vehicles, to new regions like independent robots,” Slater explained.

Why has the Scottish Mortgage share price drooped

Scottish Mortgage Investment Trust over the course of the last ten years have been helped by low interest rates.

As rates have dropped, investors, lacking alternatives, have hurried to buy development stocks – a pattern that went into overdrive in 2020/21.

Nonetheless, today investors can acquire 5% or more from high-quality bonds. That changes the equation. If I can procure 5% with limited risk, how could I attempt to pick development stocks, some of which might wind up going to nothing?

Higher rates are likewise making it harder for beginning phase and development companies to raise new assets. As these enterprises will quite often gobble up capital, simple admittance to financing and all the more importantly modest financing can be the difference among progress and failure.

Center around the drawn out potential for SMT

There’s no question the Scottish Mortgage Investment Trust is struggling against a few significant headwinds like uncertainty in China and rising interest rates, yet its portfolio is full brimming with probably the most innovative and ground breaking businesses on the planet.

For instance, a top holding is ASML, one of the main companies on the planet with the ability to deliver the equipment and devices required for semiconductor manufacturing.

Then, at that point, there’s European battery maker Northvolt. Presently the trust’s fifth-biggest holding, Scottish Mortgage thinks this private battery maker looks increasingly all around put to supply the rapidly growing expectation for electric vehicles.”

Investors might not be willing to pay as much for development stocks today as they were a year prior, yet over the long haul, organization basics matter more than anything else. As these businesses develop their top and main concerns, investors, including the Scottish Mortgage Investment Trust, should receive the benefits.