At the point when you put resources into Private Label Mortgage Backed Securities (MBS) you are buying an interest in pools of credits or other monetary resources. As the hidden advances are taken care of by the borrowers, the financial backers in these securities get installments of interest and chief after some time.

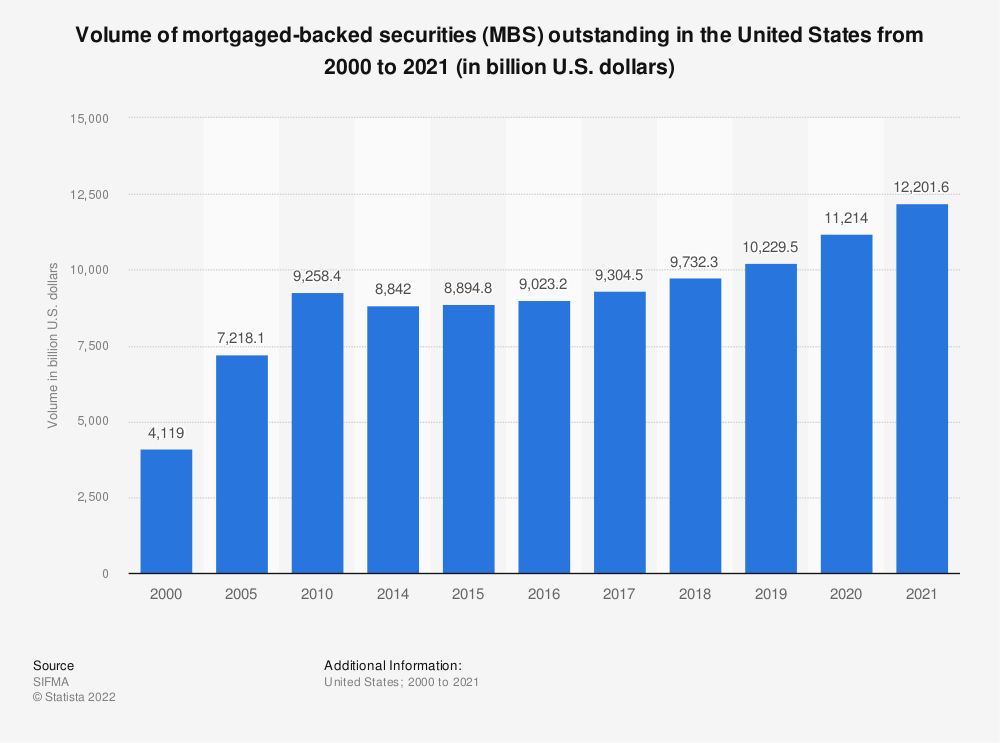

Following the monetary crisis, new securitization movement came to a standstill in all resource classes that didn’t have an implied or express government ensure. However securitization has since continued in most resource classes, including vehicles, Mastercards, collateralized credit commitments (CLOs), and business mortgage-backed securities (CMBSs), the private-label Private Label Mortgage Backed Securities market stays stale. In this short, we discuss why the private mortgage market experience has been so unique and give direction about what still needs to be fixed.

Here and there, this arrangement conspire is genuinely inconsistent. Mortgage Affordability Calculator With Student Loans credit developed over the long run from discrete areas to a continuum. As the splitting lines between prime, alt-A, and subprime credits obscured, the organizing structure turned into the essential variable distinguishing the various areas.

What Is a Mortgage-Backed Security (MBS)?

Mortgage-backed securities (MBS) are speculation items like bonds. Every MBS consists of a heap of home credits and other land obligation purchased from the banks that issued them. Financial backers in mortgage-backed securities get occasional installments like bond coupon installments.

Understanding Mortgage-Backed Security (MBS)

Private Label Mortgage Backed Securities (MBS) are varieties of resource backed securities that are framed by pooling together mortgages solely. The financial backer who purchases a mortgage-backed security is basically loaning cash to home purchasers. A MBS can be traded through a dealer. The base speculation changes between issuers.

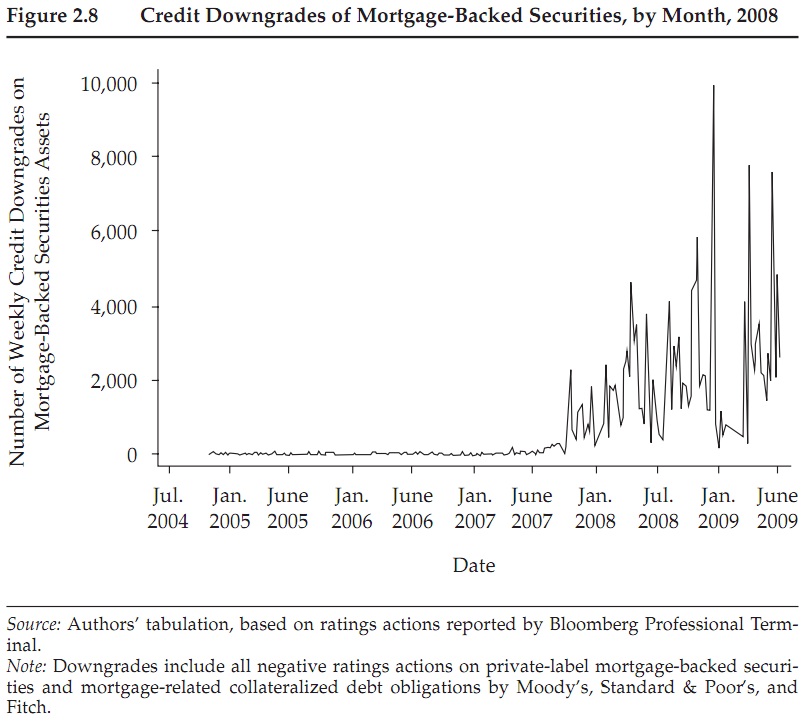

As ended up being extremely clear in the subprime mortgage total implosion of 2007-2008, a mortgage-backed security is just basically as stable as the mortgages that back it up. A MBS may likewise be known as a mortgage-related security or a mortgage go through.

Basically, the mortgage-backed security transforms the bank into a delegate between the homebuyer and the speculation business. A bank can give mortgages to its clients and afterward sell them at a discount for consideration in a MBS. The bank records the deal as an or more on its asset report and loses nothing if the homebuyer defaults in the not so distant future.

Kinds of Mortgage-Backed Securities

There are two normal kinds of MBSs: pass-throughs and collateralized mortgage commitments (CMO).

Pass-throughs: Pass-throughs are organized as trusts in which mortgage installments are gathered and gone through to financial backers. They normally have expressed developments of five, 15, or 30 years. The existence of a pass-through might be not exactly the expressed development relying upon the main installments on the mortgages that make up the pass-through.

Collateralized mortgage commitments (CMO): CMOs consist of different pools of Private Label Mortgage Backed Securities which are known as cuts, or tranches. The tranches are given FICO assessments which decide the rates that are gotten back to financial backers.

Benefits and Disadvantages of MBS

Alluring Yield

For financial backers, mortgage-backed securities enjoy a few upper hands over different securities. They pay a proper loan cost that is typically higher than U.S. government bonds. Besides, they commonly offer regularly scheduled payouts, while bonds offer a solitary single amount payout at development.

Safe Speculations

Mortgage-backed securities are likewise viewed as generally okay. In the event that a MBS is ensured by the national government, financial backers don’t need to retain the expenses of a borrower’s default. In addition, they likewise offer enhancement from the business sectors of corporate and government securities.

Prepayment Risk

In the event that borrowers neglect to reimburse their credits, the financial backer may at last lose cash. Likewise, on the off chance that borrowers take care of their credits early or renegotiate their credits, that can likewise adversely affect anticipated returns.

Loan fee Risk

MBSs are additionally delicate to changes in the financing costs on advances and mortgages. Assuming loan costs rise, less individuals will take out mortgages causing the general worth of the real estate market to decline.

The Bottom Line

A mortgage-backed security is a sort of venture vehicle made out of an enormous crate of mortgages. As every property holder takes care of their credits, the credit installments turn out a consistent revenue stream for financial backers who hold the Private Label Mortgage Backed Securities. These securities might be especially appealing to financial backers who look for openness to the real estate market, as opposed to conventional corporate or obligation securities.